EUR/CHF Testing the 50 SMA, As SNB Keeps Raising Rates on Inflation

The European Central Bank (ECB) started raising interest rates in July and it is preparing to deliver another rate hike of 75 basis points (bps) in this month’s meeting. But, the Euro continues to remain bearish, with EUR/USD falling below parity where it is feeling comfortable now.

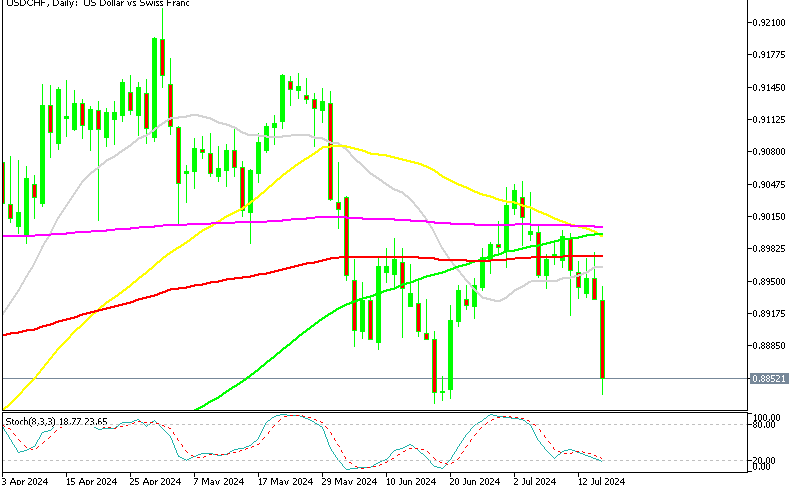

EUR/CHF has also been bearish, falling below parity since the end of June. The downtrend was quite strong during July and August, with the 20 SMA (gray) acting as resistance and keeping this pair down on the daily timeframe. Although the pace slowed in September and the 50 SMA (yellow) turned into resistance.

EUR/CHF Daily Chart – The 50 SMA Keeps Acting As Resistance

The retrace higher seems complete on the daily chart

The Swiss National Bank (SNB) has raised interest rates twice in the last two meetings, by 50 bps and 75 bps. This has given the CHF further fuel, as inflation has been growing as well. Swiss CPI (consumer price index) reached 3.5% in August, although it remains a long way from the 10% that we saw in the Eurozone.

Nonetheless, these are some strong numbers for Switzerland where inflation has always remained low. SNB officials are sounding hawkish after two hikes, which will keep the CHF bullish and EUR/CHF bearish, so we are thinking about selling this pair at the 50 daily SMA, with the stochastic indicator being overbought, which suggests that the retrace is over.

SNB governing board member Andrea Maechler said last week that “The Swiss National Bank will do everything to reduce inflation”, adding that last week’s rate hike was intended to signal the central bank’s determination to fight price increases in Switzerland. “We have tightened monetary policy and raised interest rates to send a clear signal that we will do everything to bring down inflation over time,” Maechler told broadcaster SRF in an interview to be shown later on Monday.