GBP/USD Slips to $1.0925 Support – UK GDP Figures in Focus

The GBP/USD is trading with a slight bearish bias at the $1.0985 level as investors are waiting for the UK GDP figures. The monthly

The GBP/USD is trading with a slight bearish bias at the $1.0985 level as investors are waiting for the UK GDP figures. The monthly publication of August 2022 Gross Domestic Product (GDP) numbers is scheduled for the early hours of Wednesday, at 06:00 GMT, on the British economic calendar. Details about the period’s trade balance and industrial production add to the importance of that time.

It’s worth mentioning that the Bank of England’s (BOE) action increases the significance of today’s UK data dump for GBP/USD traders. Following a 0.2% increase in economic activity in July 2022, market participants will look for August GDP numbers to confirm their predictions of an economic downturn.

According to forecasts, the UK’s GDP would remain stagnant in August, with 0.0% MoM data. For more information, GBP/USD traders will also look at the Index of Services (3M/3M) for the same period, which is expected to rise to 0.2% from -0.2%. Meanwhile, manufacturing production, which accounts for around 80% of overall industrial output, is predicted to fall by 0.0% month on month in August.

Furthermore, total industrial production is predicted to improve to -0.2% from -0.3%. In terms of yearly data, August industrial production is forecast to be 0.6% lower than the previous month, while manufacturing production is expected to be 0.8% lower than the previous month.

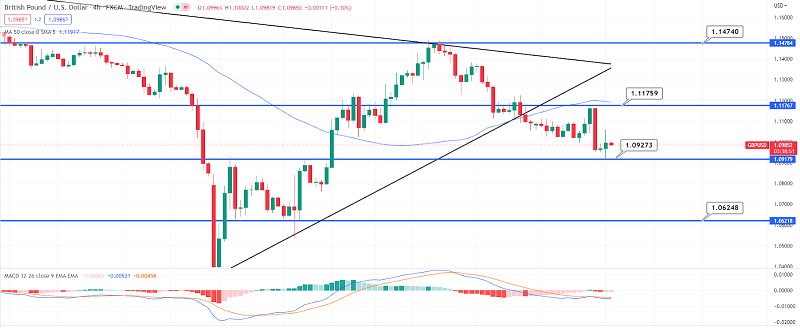

GBP/USD Technical Outlook

The GBP/USD pair fell sharply yesterday, breaking the 1.1015 level and closing the daily candlestick below it, supporting the continuation of the expected bearish trend scenario for the forthcoming years, and the path is clear to our next main target of 1.0845.

The negative effect of the head and shoulders pattern is still active, and the EMA50 continues to back the suggested bearish wave, taking into account that holding below 1.1015 represents the initial condition for the expected decline to continue.

Today’s trading range is expected to be between 1.0850 support and 1.1015 resistance.

Today’s expected trend is bearish.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account