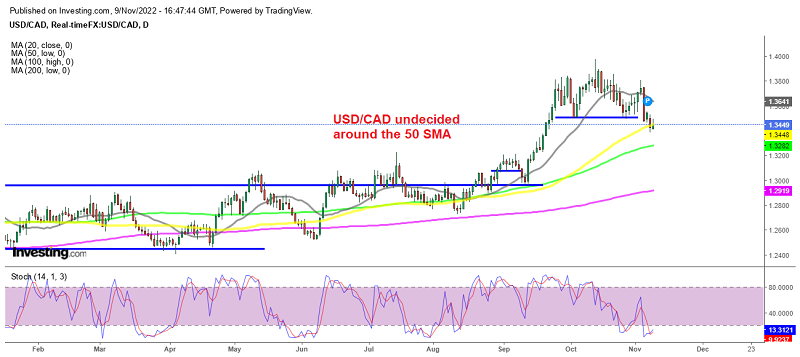

Is USD/CAD Reversing Higher As Crude Oil Falls?

Crude Oil has been declining for three days now, which might help USD/CAD gain some momentum as it tries to reverse higher

USD/CAD has been bearish since early October and the decline has picked up pace in recent days, although this forex pair is attracting some buying today which is building on the previous day’s late rebound from its lowest level since September 21. This pair is making gains today as it pushes above mid-1.3400s through the first half of the European session and is supported by a number of factors.

Crude Oil continues to decline for the second straight day after the heavy overnight losses, which in turn, is seen undermining the commodity-linked CAD. China’s zero-COVID policy could dent fuel demand in the world’s top crude importer and recent developments there aren’t too favourable for Oil bulls.

Furthermore, today the EIA inventories showed a 3.9 million barrel buildup, which comes after yesterday’s American Petroleum Institute report that showed US inventories growing by 5.6 million barrels in the week to November 4, further reflecting a drop in demand and continuing to weigh on Oil prices.

Crude Oil Daily Chart – The 200 SMA Turns Into Resistance

Sellers now facing the 50 SMA

These factors, along with the emergence of some USD buying after another decline earlier today, are helping USD/CAD buyers. Oil is now facing the 50 SMA (yellow) on the daily chart, which might provide some support.

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account