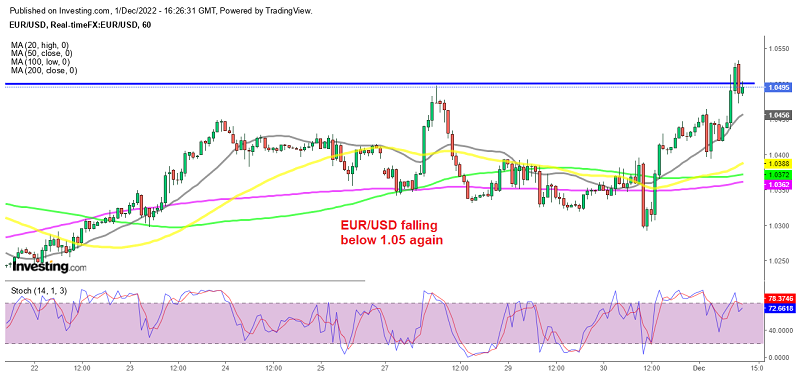

EUR/USD Retreats Below 1.05 After ISM Manufacturing Falls in Contraction

•

Last updated: Thursday, December 1, 2022

The USD has been retreating in the last two months, although we saw some sort of a comeback last week. Although the decline resumed again this week as the sentiment improves on hopes of a Chinese reopening and a FED slowdown. As a result, EUR/USD pushed above 1.05 after Jerome Powell’s comments yesterday about slowing rate hikes. Today after the ISM manufacturing report was released which fell below the 50-point level, EUR/USD reversed and fell below 1.05, after trading as high as 1.0530s.

November US Manufacturing PMI from the ISM

- November US ISM manufacturing index 49.0 points vs 49.8 expected

- October ISM manufacturing was 50.2 points

- Estimates ranged from 48.0 points vs 50.4

- Prices paid 43.0 points vs 47.5 expected (prior 46.6)

- Production 51.5 points vs 52.3 prior

- Employment 48.8 points vs 50.0 prior

- New orders 47.2 points vs 49.2 prior

- Order backlog 40.0 points vs 45.3 prior

- New export orders 48.4 points vs 46.5 prior

This is the first reading below 50 in two-and-a-half years. I’d be surprised if the market was priced at the ‘consensus’ because the regional numbers have been soft.

Comments in the report aren’t positive:

- “Customer demand is softening, yet suppliers are maintaining high prices and record profits. Pushing for cost reductions based on market evidence has been surprisingly successful.” [Computer & Electronic Products]

- “Future volumes are on a downward trend for the next 60 days.” [Chemical Products]

- “Orders for transportation equipment remain strong. Supply chain issues persist, with minimal direct effect on output.” [Transportation Equipment]

- “Consumer goods are slowing down in several of our markets, although the U.S. economy seems decent. Cannot say the same for the European economy.” [Food, Beverage & Tobacco Products]

- “General economic uncertainty has created a slowdown in orders as we approach the end of the year, and many of our key customers are reducing their capital expenditures spend.” [Machinery]

- “Overall, things are worsening. Housing starts are down. We’re doing well against our competitors, but the industry overall is down. We’re sitting on cash (that is) tied up in inventory.” [Electrical Equipment, Appliances & Components]

- “The market remains consistent: sales match expectations; there are concerns about the impact of rising interest rates on customers; most suppliers have recovered on labor, but some are still struggling; and inflation seems to have peaked, but commodity price decreases have not been passed through to us. Lots of unknowns regarding impact to the European Union from the Russia-Ukraine war and questions about customer behavior in 2023.” [Miscellaneous Manufacturing]

- “There is caution going into 2023, but the commercial section of construction seems to still be going strong.” [Nonmetallic Mineral Products]

- “Looking into December and the first quarter of 2023, business is softening as uncertain economic conditions lie ahead.” [Plastics & Rubber Products]

- “Slight improvement on overall business conditions from the previous month.” [Primary Metals]

Note the collapse in the backlog of orders:

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.