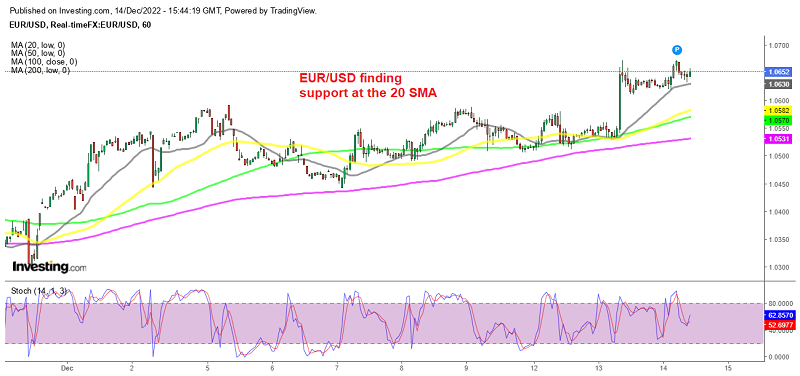

EUR/USD Holds Gains Above 1.06 As the FED Rate Hike Approaches

EUR/USD is finding support at the 20 SMA on the H1 chart. holding well above 1.06 and we decided to open a small buy signal

The situation in EUR/USD looks much better now than two months ago, when it fell below parity and was trading below 1.05 for some time, with the FED in the middle of one of the steepest tightening cycles ever, while the sentiment was also quite negative in financial markets. But, the sentiment has improved since then and the FED is slowing down already, with a 50 basis points (bps) hike expected today after three 75 bps rate hikes in the last three meetings.

The FED has placed attention on inflation and yesterday’s US consumer inflation report CPI (consumer price index) showed a decent cool-off to 7.1% in November from 7.7% in October. This relieves some of the pressure from the FED, hence the 150 pip dive in the USD yesterday, while risk assets surged higher.

EUR/USD surged from 1.0530s to 1.0670s as traders got excited and the terminal top rate from the FED declined below 5%. Although the surge stalled there and today we have seen some consolidation ahead of the FED rate decision later in the evening.

The Eurozone industrial production for October showed a contraction, so the situation in the Eurozone economy is not good either and tomorrow the ECB will be in the spotlight as well, after the 50 bps hike which is also priced in. But, inflation is still higher in Europe than in the US, which might keep this pair bullish a bit longer.

Eurozone October Industrial Production

- October industrial production MoM -2.0% vs -1.5% expected

- September industrial production was +0.9%; revised to +0.8%

- Industrial output YoY +3.4% vs +3.4% expected

- Prior industrial production YoY was +4.9%; revised to +5.1%

Looking at the details, it was a widespread drag in terms of industrial output as we saw a decline in intermediate goods (-1.3%), energy (-3.9%), capital goods (-0.6%), and durable consumer goods (-1.9%) on the month.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account