GBP and JPY on Retreat As Risk Assets Turn Bearish After Rate Hikes

Risk sentiment has turned negative after rate hikes by four major central banks in the last two days, sending risk assets lower

Yesterday the FED delivered a 50 basis points (bps) rate hike, which was a slowdown from the four 75 bps hikes in the previous four meetings. Although, that was already priced in by the markets and the interest was on the press conference from Powell, similar to the ECB meeting today which produced a 50 bps rate hike, but Christine Lagarde’s speech got the markets going.

Comments from Powell were less hawkish than expected and the USD reversed lower after the first pop following the rate decision. But, overnight the USD reversed again and has been gaining since then, with risk sentiment turning negative in the financial market.

Today ECB president Christine Lagarde sounded more hawkish than anticipated especially after the comment that “the ECB says will need to raise rates significantly”. That has been keeping the sentiment negative and the USD has advanced higher, while risk assets are diving. US stock markets opened lower while USD/JPY has made a strong reversal pushing above the 100 SMA (green). We opened a sell signal last night below this moving average as it was providing resistance but buyers have broken above it now.

USD/JPY H4 Chart – Buyers Pushing the Price Above MAs

Is the decline over for USD/JPY?

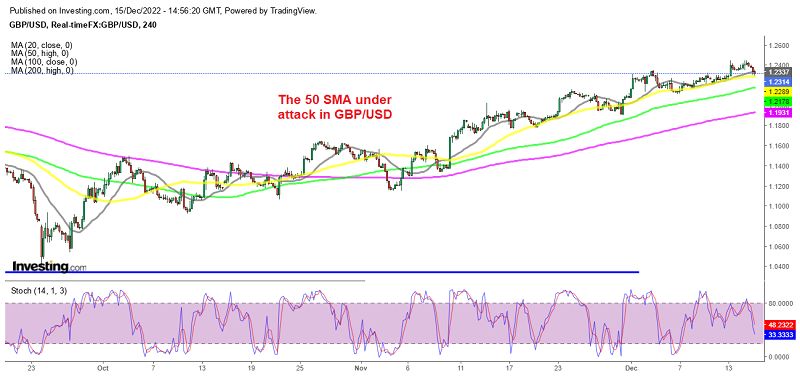

On the GBP/USD chart at the top of this article, buyers seem to be in charge as the trend remains bullish, despite the recent retreat. The 50 SMA (yellow) has been acting as support on the H4 chart, but is under attack now after the retreat despite the rate hike by the BOE, although they did sound sort of dovish today.

The Bank of England Monetary Policy Decision – 15 December 2022

- Bank of England Official Bank Rate 3.50% vs 3.50% expected

- Prior official bank rate was 3.00%

- Bank rate vote 7-2 vs 9-0 expected (Tenreyro, Dhingra voted to keep rates unchanged at 3%, Mann voted to raise rates by 75 bps instead)

- Further increases in bank rate may be required

- Q4 GDP seen at -0.1% QoQ (previously -0.3% in November)

- Labour market remains tight

- Inflation expected to fall gradually in Q1 2023

- But there has been evidence that could indicate greater persistence of inflation

- That justifies a further forceful monetary policy response

- BOE will consider and decide the appropriate level of bank rate at each meeting

- Full statement

The first detail that you can see here are the 2 votes against which sent the GBP lower. That, together with some less hawkish changes in the rhetoric, makes for a more dovish rate hike by the BOE. According to the latest projections by the BOE, inflation has peaked so Tenreyro and Dhingra who dissented argued that 3% rates are “more than sufficient” to bring inflation back towards 2%.

GBP/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account