Will FOMC Minutes Send the USD Higher Again?

The USD ended up higher after the last FED meeting, so today's FOMC minutes point to more bullish momentum for the USD

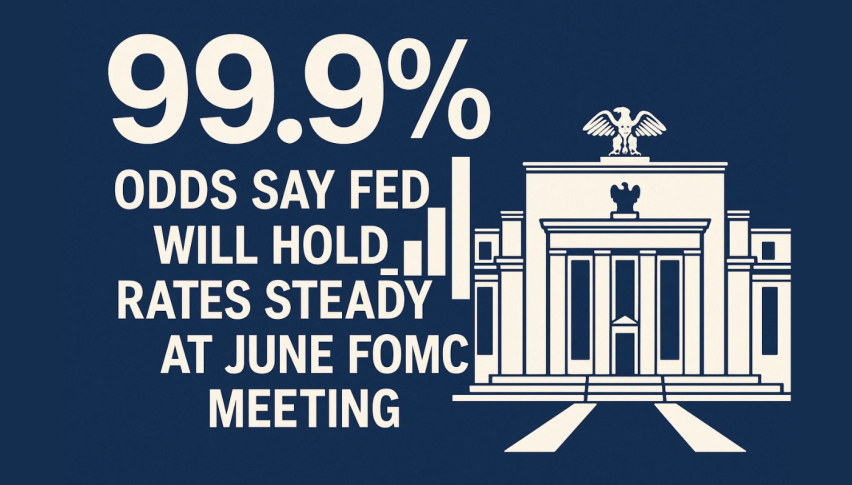

The Federal Reserve slowed down with interest rate hikes in last month’s meeting, delivering a 50 basis points (bps) hike after several 75 bps hikes in a row. The USD dived initially but then reversed back up and ended higher. Today, we have the FOMC minutes from that meeting, which will be released in the evening.

Although economists see the minutes as hawkish for the USD. Citi says that officials at the Federal Reserve are “clearly growing more uncomfortable with the market underpricing their likely policy path”. Citi forecasts a 50bp rate hike at the next meeting, in February. ProjectMorgan Stanley sees the terminal rate at 5.25 – 5.50%.

Morgan Stanley’s note says they see financial conditions being “too easy”. A reflection of a “misperception among investors of the Fed’s reaction function”. MS say the implication is that as long as financial conditions are misaligned with the Fed’s aims, “expect additional tightening”.

Meanwhile, the Minneapolis FED president Kashkari was speaking yesterday saying that the fed should keep raising interest rates, which is a bullish signal for the USD. Below are his comments:

- Appropriate to continue interest rate hikes at least at the next few meetings until confident inflation has peaked

- Increasing evidence that inflation may have peaked

- Fed should then hold target interest rate and says his forecast is that would be at 5.4%

- Won’t know if that is high enough until fed pauses for a reasonable period of time

- Once Fed allows for policy lag effects, can then assess if rates need to go higher or remain at peak for longer

- In this phase any sign of slow progress on lowering inflation will require taking policy rate potentially much higher

- Fed can consider cutting rates only once convinced inflation well on its way back down to 2% target

- Fed must avoid cutting rates prematurely and having inflation flare up again as that would be a costly error

A year ago, Kashkari was one of the more dovish of the Fed officials arguing consistently that inflation was a transitory. Now he targets the terminal rate above what the Fed had set at their December meeting of a 5.1%, and has shifted his chatter toward the more hawkish side.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account