Gold Price Forecast: XAU/USD Headed For $1,890 As Pressure Mounts

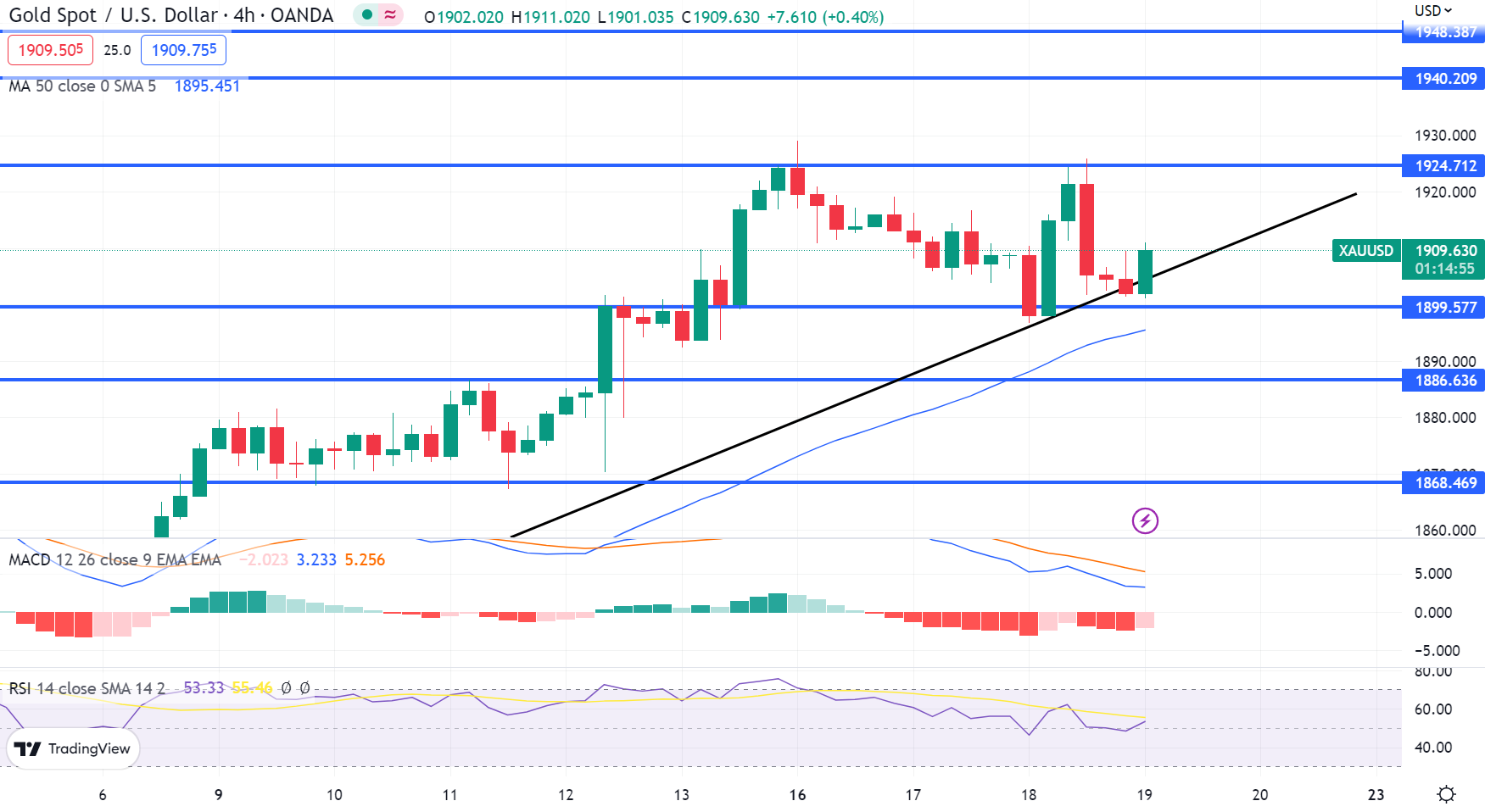

The price of [[gold]] is currently sitting near its weekly low of around $1,900 as it continues to decline for the fourth day in a row.

The price of GOLD is currently sitting near its weekly low of around $1,900 as it continues to decline for the fourth day in a row. The US Dollar has recovered from its multi-day low, and Fed officials are sending mixed signals with their data.

GOLD prices are affected by mixed sentiments surrounding China, one of the biggest XAU/USD consumers. Moreover, US Treasury bond yields have hit a lull due to renewed recession fears, adding downward pressure on gold amid a low-intensity market. As the Chinese Lunar New Year holidays are right around the corner, central bankers may be engaging with gold traders as a way to prepare for what is likely to be an inactive week.

The GOLD price has rebounded and is now attempting to climb back up above the $1,915.00 mark, suggesting a potential resurgence in its bullish trend. Until we see it break above this resistance or fall below 1900.00 support, we advise waiting before making any decisions on its current trajectory.

If the resistance level is broken, the market can be expected to reach new highs starting at $1,928.60 and going up to $1,950. On the other hand, if support is breached, a bearish trend may start with its next target of $1,885.

The anticipated trading range for the day is between 1890.00, a level of support, and $1,928, which is the level of resistance.

For today, it looks like the trend is going to remain steady and neutral.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account