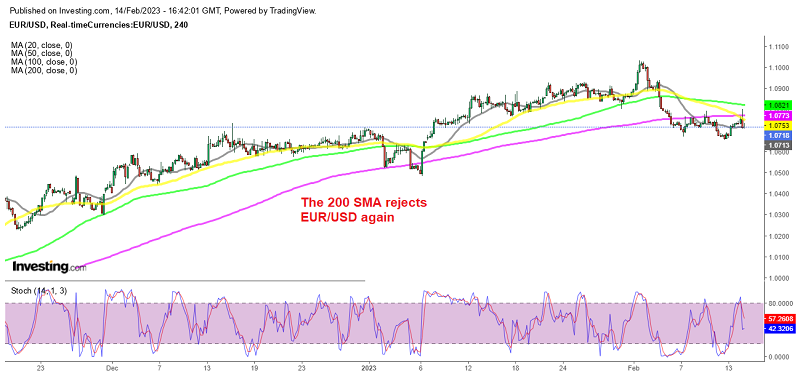

More Signs That EUR/USD Is Turning Bearish After the 3rd Rejection by the 200 SMA

EUR/USD returned back below the 200 SMA for the third time today after the US CPI data, indicating strong resistance at the 200 SMA

After the strong bearish reversal which followed the very strong NFP employment and ISM services reports, EUR/USD pushed below all moving averages on the H4 chart, including the 200 SMA (purple), which was the last line of defence for the buyers.

Right now, the moving averages are indicating a shift in trend as the shorter period moving averages such as the 20 SMA (gray) and the 50 SMA (yellow) have fallen below the long period ones. The price is finding resistance there, which would be in the 1.08 zone.

EUR/USD moved higher in the Asian and European sessions earlier today, following yesterday’s mode and in the process moved up to test a key technical level ahead of the key inflation report which was released earlier today. The US CPI was expected to rise by 0.5% which came as expected in January versus 0.1% in December, while core CPI jumped by 0.4% versus 0.3% last month.

So, inflation was a bit hitter than expected and this pair reversed lower after piercing the 200 SMA for the third time, This is the third rejection, which is a strong signal that buyers are having difficulty pushing the price above 1.08. If something can’t go up it will go down, so the price is heading down indeed and we remain short on this pair. FED’s Logan made some hawkish comments on rate hikes after the report, which is going to keep the USD bullish and EUR/USD bearish.

Comments from Boston Fed President Logan

- Fed must be prepared to keep raising rates longer than anticipated, if needed

- Even after pausing, need to stay flexible then tighten further if conditions call for it

- Need continued gradual rate hikes until we see convincing evidence inflation is falling to 2% in a sustainable, timely way

- Tightening policy too little is the top risk

- Tightening too much or too fast risks weakening the labor market more than necessary

- Should not lock in a peak Fed policy rate or precise rate path

- There has been some progress, need to see slower inflation in services

- Little sign of improvement in core services ex housing inflation

- Need a better balance in labor market to bring inflation back to 2%

This is a decidedly different tone than Powell struck at the last FOMC.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account