Looking to Sell the Retreat in the USD As Data Shows Further Improvement

The USD showed strong bullish momentum yesterday as the sentiment turned negative on Powell’s comments that rates could go up to 5.75%. Risk currencies tumbled around 150 pips lower, while Gold decline around $40.But, tody we are seeing a retreat in the USD after the Federal Reserve Chair began his testimony, stating that a 50 bps rate hike in March is still uncertain and dependent on the release of upcoming economic data, such as employment and Consumer Price Index (CPI) reports.

He also mentioned that the positive economic data from January may have been influenced by favorable weather conditions and seasonal factors. Currently, there is an expectation for Friday’s job report to show an increase of 225,000 jobs with an unemployment rate of 3.4%.

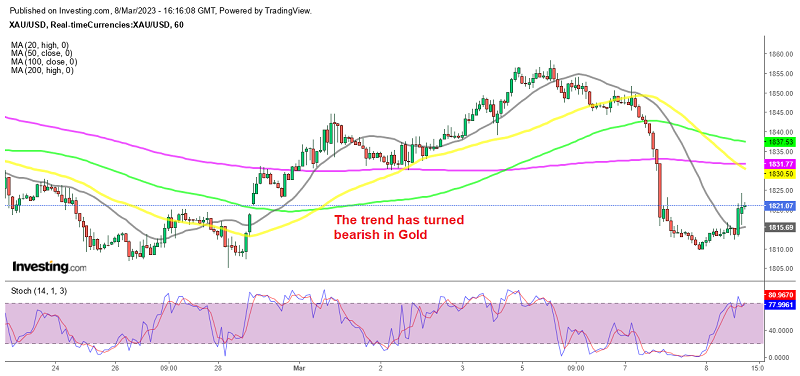

This sent the USD lower, but today’s economic data has been positive, which goes in favour of a stronger hike in March. Gold increased from below $1,810 earlier today, to $1,824 after Powell’s comments as the USD retreated lower. But, we decided to open a long term sell Gold signal, taking into account today’s data as well.

US February 2023 ADP Employment Report

- ADP February employment K +242K vs +200K expected

- January employment was +106K (revised to +119K)

- Annual pay increase of job stayers +7.2% vs +7.3% prior

- Pay increase of job changers +14.3% vs +15.4% prior

- Small companies -56K

- Midsized +77K

- Larger +160K

The data series being referred to here is displaying a different path compared to the non-farm payroll report. However, it does show an improvement from the lowest point seen in the past year. The report emphasizes the dynamics of wage inflation.

“We’re seeing robust hiring, which is good for the economy and workers but pay growth is still quite elevated. The modest slowdown in pay increases, on its own, is unlikely to drive down inflation rapidly in the near-term,” the survey said.

Gold XAU Live Chart