USD Continues Sliding After Higher German CPI Ahead of EU Inflation Numbers

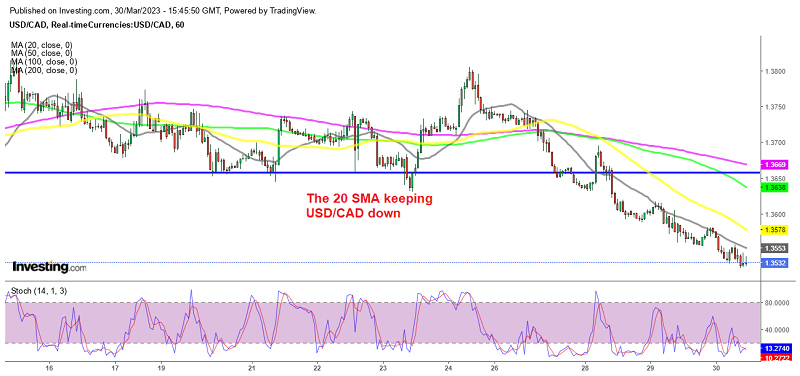

EUR/USD has been bullish this week as the USD continues to slide lower. The CAD has also been making decent gains, with USD/CAD falling from 1.38 to 1.3520s, where we opened a sell forex signal as we earlier today. The selloff in the USD has continued today and we saw a 100 pip decline almost, as EUR/USD jumped above 1.09 and pulling other risk assets higher against the USD, following the release of German inflation figures this morning.

German CPI fell less than economists were expecting in March despite a significant drop in energy costs. The annualized increase in harmonized German consumer prices was 7.8%, which was higher than the 7.5% predicted. The report came hours after Spain’s annual CPI (consumer price index) nearly halved to 3.1% in March from 6% in the February. Although, Germany has a lot more weight in the EU, so the Eurozone inflation numbers tomorrow will likely follow the German numbers.

The ECB is considering whether to pause interest rate increases when it meets in May. Following the publication of Germany’s inflation figures, yields on interest rate-sensitive two-year debt increased by 0.08% to 2.7%, as investors anticipated a further increase in borrowing costs in the Eurozone. The primary reason for the drop in the German consumer price index was a decrease in energy inflation from 19.1% in February to 3.5% in March. However, this was partially offset by a slight acceleration in food inflation by 22.3% and service price growth by 4.8%.

German CPI Inflation Report by Destatis – 30 March 2023

- March preliminary CPI YoY +7.4% vs +7.3% expected

- February CPI was +8.7%

- CPI MoM +0.8% vs +0.7% expected

- Prior CPI MoM +0.8%

- HICP YoY +7.8% vs +7.5% expected

- Prior HICP YoY was +9.3%

- HICP MoM +1.1% vs +0.8% expected

- Prior HICP MoM was +1.0%

The decrease in year-on-year inflation in March compared to February is largely due to the adjustment for base effects, given the significant increase in oil prices last year during the Russia-Ukraine conflict. However, there is more concern regarding the continued rise in prices, as seen from the monthly readings. This will be more important towards the end of the year.