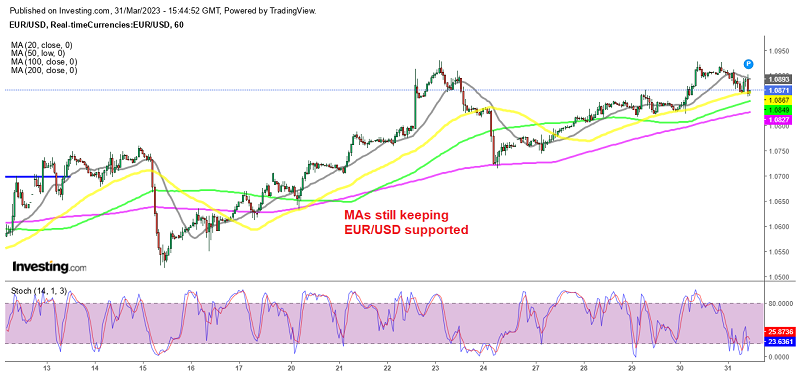

USD Makes A Small Comeback Before Weekend Despite Slowing PCE Inflation

EUR/USD has reversed off the highs despite PCE confirming the slowing trend in inflation and lower FED terminal rate

The USD has been in a retreat since October, as inflation CPI (consumer price index) started to cool off and the FED started to turn the rhetoric less hawkish. They have slowed down with rate hikes, with 25 bps being the norm now, after several 75 bps hikes last year. In February we saw a comeback in the USD as the economic data showed improvement, but as the bank issues get resolved the sentiment improves, the USD keeps retreating. Although we saw a dip and a bullish reversal on Friday afternoon after the PCE inflation report, sending EUR/USD to 1.09 before reversing back down.

The latest inflation numbers from the US showed that last month, the core PCE inflation rate slipped to at 4.6%, which is slightly lower than the 4.7% expected. This suggests that the inflation pressures are beginning to ease. Over the past two years, inflation numbers have been higher than anticipated, which caught the FED by surprise. However, with improved supply chains, lower Oil prices due to bank troubles and higher interest rates, inflation numbers are starting to fall.

In terms of monthly changes, the headline and core inflation rates increased by 0.3%, which is still above the target rate when annualized. However, this is an improvement from the previous month, as both rates have been cut in half. This is a positive indication that inflation is moving in the right direction.

US February PCE Core Inflation Report

- February PCE core inflation 4.6% vs 4.7% expected

- January PCE inflation was +4.7%

- February PCE core MoM +0.3% vs +0.4% expected

- January core PCE MoM was +0.6%

- Headline inflation PCE +5.0% vs +5.4% prior

- Deflator MoM +0.3% vs +0.6% prior

Consumer spending and income for November:

- Personal income +0.3% vs +0.2% expected. Prior month +0.6%

- Personal spending +0.2% vs +0.3% expected. Prior month +1.8%

- Real personal spending -0.1% vs +1.1% prior

The fall in inflation numbers leads to a less hawkish FED regarding interest rates, even as banking conditions improve. According to FED fund futures, there is currently a 55% chance of a 25 basis point hike at the May 3 meeting, but the market predicts that this will be the peak and that there may be potential for rate cuts later in the year. But, the USD reversed the losses after the PCE report, which is a positive sign for next week after closing a bearish week.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account