Disappointing Philly FED Manufacturing and Falling Prices

On Monday, New York manufacturing showed a decent jump but today's Philly FED manufacturing tumbled lower and prices fell too

The USD has been making some gains since last Friday, after losing considerable ground in previous weeks on falling inflation and softening economic data from the US. But, it is currently at its lowest point after the soft April manufacturing survey from the Philadelphia FED. That has sent the Treasury yields down, which is weighing on the USD. The survey showed a major decline of activity into negative territory, while drawing attention to the issue of inflation as well.

The prices received index has declined to the lowest level in three years, since the height of the coronavirus lockdowns in May 2020, which suggests that inflation is no longer a major concern. Despite this, the market is still predicting a 90% chance of a 25 basis point hike by the Fed in the next meeting in May, but there is only a moderate chance of another rate hike after that.

The speeches from the FED members Waller and Mester, both of whom are hawks, are likely to focus on continuing to hike or at least maintaining restrictive policies for a longer period. However, recent data shows that inflation is heading back to normal levels while economic activity is slowing, which could result in an unnecessary recession that may force the FED to cut interest rates later this year.

So, the US dollar is also under pressure and weakening against commodity currencies. This may be due in part to the decline in US 2-year yields, which fell by 8.2 basis points to 4.18% following five days of gains. AUD/USD and NZD/USD are around 50 pips higher, while GOLD popped above $2,010 but it has retreated back down.

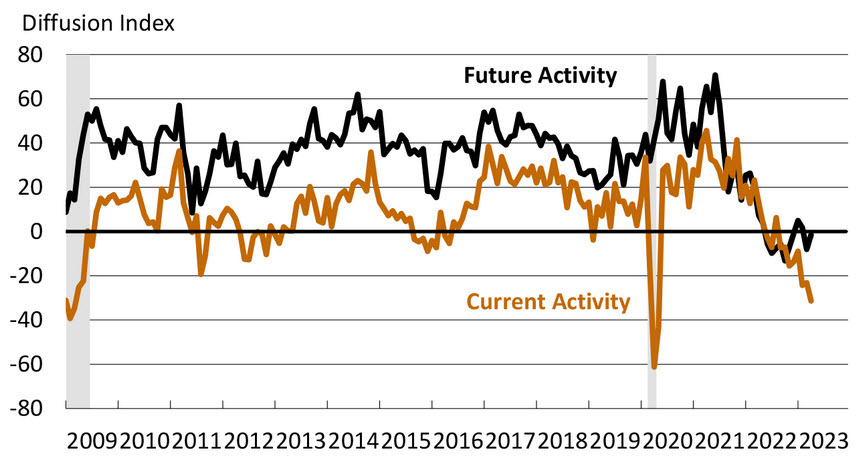

US Philadelphia Manufacturing Survey for April 2023

- April Philly FED manufacturing -31.3 vs -19.2 expected

- March Philly FED manufacturing was -23.2

- New orders -22.7 vs – 28.2 prior

- Employment -0.2 vs -10.3 prior

- Avg workweek -8.4 vs -3.2 prior

- Capex -5.4 vs -3.8 prior — lowest since March 2009

- Prices paid +8.2 vs +23.5 prior

- Future activity -1.5 vs -8.0 prior

- Delivery times -25.0 vs -24.3 prior

- Unfilled orders -11.1 vs -21.3 prior

- Full report

Based on the reported data, it appears that the prices of goods and services are decreasing, with only a small percentage of firms reporting an increase in input prices. Additionally, the prices received index has dropped to a negative reading, which is the first time this has happened since May 2020.

Despite this trend, the Federal Reserve is still raising interest rates, which may be impacting demand. As a result, there is a growing concern that the Fed may not be responsive enough to change economic conditions, which could lead to a harsh recession.

In terms of wages and compensation, over half of the firms have reported increases in the past three months, and a significant number of firms are planning to increase wages and compensation beyond their original budgets for 2023.

Gold XAU Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account