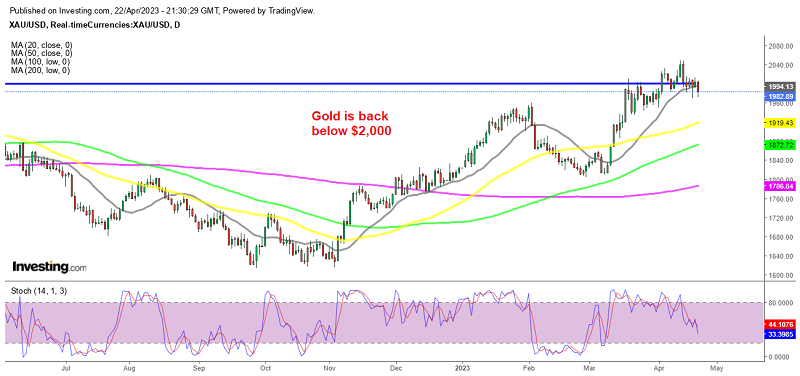

Is the Uptrend Over in Gold After Breaking Below the 200 Daily SMA?

Gold fell below the 20 SMA on the daily chart last week, suggesting that the bullish trend might be over after failing to hold above $2,000

Gold has shown extreme resilience since November, gaining more than $400 as the uncertainties remain high all over the globe, including politics, financiers, economic as well as social. XAU/USD pushed higher around 10 days ago, but the higher inflation expectations from the UoM send the USD higher and Gold reversing sharply lower.

Although, the 20 SMA (gray) which has been acting as support before, held the decline. Throughout most of last week, XAU/USD was trading in a range around the $2,000 level. But we can that on Friday a sharp decline took place towards the end of the European session, which sent Gold around $30 lower, pushing it below the 20 daily SMA where it closed the week.

Two days ahead of that, Gold pierced the 20 SMA in a similar move which also breached the ascending channel but eventually, XAU reversed back above it. Therefore, the daily close below this moving average is crucial in determining the trend for this week, as the breakout suggests that buyers have lost strength.

FED officials contributed to the decline, acknowledging that inflation is still well above the central bank’s 2% target, with FED’s Bowman emphasizing that more measures (rate hikes) need to be taken to control inflation. Although a rate hike may initially reduce Gold’s attractiveness, eventually, when the FED pauses, GOLD will likely resume the uptrend and rise to its recent record highs, according to market strategists. After all, the FED has an upper limit beyond which it cannot raise rates without causing significant harm to the economy.

Gold was also under pressure from the US PMI manufacturing and services report released on Friday, indicating U.S. business activity had risen to an 11-month high in April, which contradicts growing indications that higher interest rates are slowing demand. However, given the strong bullish trend, this recent move lower could provide better levels to buy in case of a bullish continuation higher. There is still decent support at around $1,970 and $1,960.

Gold XAU Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account