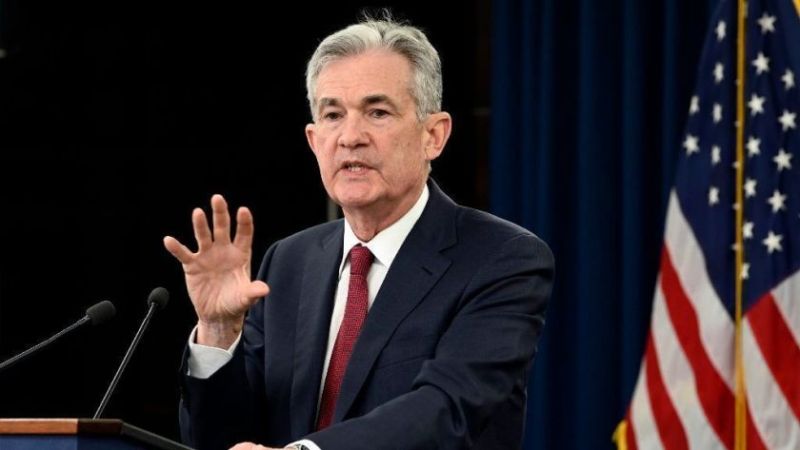

Forex Signals Brief May 4: No Rate Cuts From the FED, Leaving Markets in Doubt

Traders were expecting the FED to hint at rate cuts after yesterday's 25 bps hike which was the last one, but Powell said refused the idea

Yesterday’s Market Wrap

Yesterday the USD continued the retreat for most of the day as markets were anticipating a dovish FED rate hike, which would be bearish for the USD. Risk assets were crawling higher, with commodity dollars on a slight bullish trend, after comments that the Reserve Bank of Australia is not done with rate hikes yet, after the surprise hike on Tuesday. The Q1 employment report from New Zealand was positive as well.

The ADP Non-Farm Employment Change and the ISM Services PMI were the last data points before the FOMC meeting in the evening, both of which came out positive. That might have given the FED some more room to breathe after the resurfacing of the banking sector issues in the US. The FED raised interest rates by 25 bps, to the range of 5.00%-5.25%, which is most likely the last one. Although, Powell said that they would take a data-dependent approach and that it’s not appropriate to cut rates. That left traders a bit disappointed and after the initial fall, the USD reversed higher toward the end of the US session.

Today’s Market Expectations

Today started with the Caixin manufacturing PMI from China which showed that activity remains weak. The final Eurozone services read for April came mostly unchanged, which shows that this sector is in decent shape. Later before the US session starts, the European Central Bank will hold it’s meeting and expectations are for a 25 bps rate hike to 3.75%, although they might surprise with a nigger-than-expected rate hike.

Forex Signals Update

Yesterday markets were mostly quiet, with a slight bearish tilt on the USD, so the the volatility was low during the European session and most of the US session. So, we kept the number of signals low with the FOMC meeting approaching. We opened four trading signals, with one closing in profit and one in loss.

GOLD Still Heading for All-Time Highs

Gold was trading in a range for two weeks since the middle of April, although buyers came back as soon as the 200 SMA (purple) caught up with the price. Gold jumped to $2,020 on Wednesday and the bullish momentum continued yesterday after the FED meeting, pushing the price to $2,037.

XAU/USD – 240 minute chart

EUR/USD Feeling Comfortable Above 1.10

EUR/USD has been bullish for some time and it pushed above 1.10 in January. The price retreated lower in February as the USD buyers returned but since then this pair has tried to break above this major level several times. Although it has slipped back below, so traders weren’t feeling comfortable keeping the price above here. Although now they look more comfortable as this pair stays above this level.

EUR/USD – 240 minute chart

Cryptocurrency Update

The 50 SMA Holding BITCOIN Up

Bitcoin has been making lower highs since the middle of April, but looking at the daily chart, we can see that it is still on a bullish trend, as the lows keep getting higher, while moving averages are acting as support. BTC climbed above $30,000 last month, as the uncertainty in traditional banking sent cash flows toward the crypto market, although it hasn’t progressed higher, but the chart setup shows us that the bullish momentum might pick up again soon after the 50 SMA (yellow) caught up with the price.

BTC/USD – Daily chart

ETHEREUM Remains Suported

Last week, the price of Ethereum dropped below $1,900, but it found support at the 50-day SMA at $1,800. As a result, we opened a buy signal for Ethereum, which looked promising as the 50 SMA provided support during the retreat. Yesterday, Ethereum saw an increase in value towards $2,000, but the climb was halted by the 20 SMA (gray), causing ETH to reverse back down to the 50 SMA.

ETH/USD – 240 minute chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account