Weaker Fundamentals Keeping AUD Soft

AUD/USD is feeling the weight from softer economic data from China and global recession fears which will likely keep it bearish

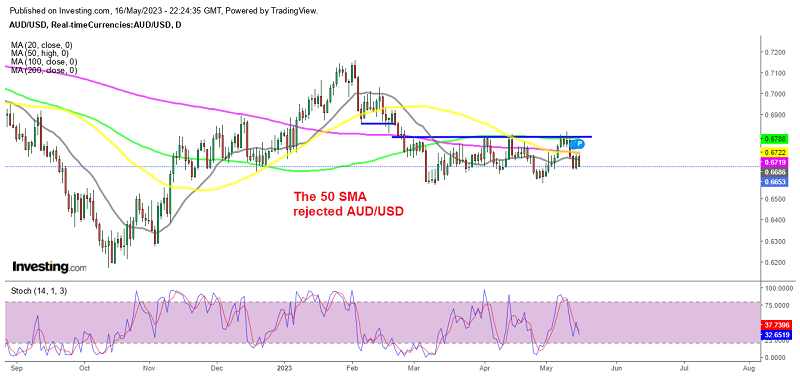

AUD/USD stabilized in March after the retreat in February as USD buyers returned again on stronger US economic data. Since then this forex pair has been trading in a range, with the top at around 0.68 and the bottom below 0.66. Last week we saw a reversal at resistance and yesterday sellers came back after a rejection at the 50 SMA (yellow) on the daily chart.

The Aussie experienced a decline due to concerns about China’s economic recovery, as yesterday’s data indicated a slowdown in activity. Chinese industrial production for the period ending in April came in at 5.6% year-over-year, falling short of the forecasted 10.9%. Similarly, retail sales during the same period reached 18.4%, below the expected 21.9%. Fixed asset investment, excluding rural and property investment, also missed estimates, recording a 4.7% growth, while property investment showed a decline of -6.2%.

These figures follow soft inflation numbers from the previous week, and the People’s Bank of China (PBOC) maintains the 1-year medium-term lending facility (MLF) rate at 2.75%, though injecting CNY 25 billion of liquidity. Prior to the release of Chinese data yesterday, the Reserve Bank of Australia (RBA) meeting minutes revealed that the decision to raise interest rates at the May meeting was carefully balanced between keeping the cash rate unchanged or hiking it by 25 basis points.

The case for keeping rates unchanged primarily relied on the recent slowdown in inflation, with consumer inflation CPI slowing to 7.0% on an annualized basis until the end of March, down from 7.8% in December. Today the Wage Price Index report for Q1 was released.

Q1 Wage Price Index in Australia

Australian Wage Price Index for Q1 2023 (January – March)

- Q1 wage price index +0.8% QoQ vs 0.9% expected

- Prior wage price index was 0.8%

- Wage price index YoY +3.7% vs 3.6% expected

- Prior was 3.3%

—

The Australian Wage Price Index (WPI) is a quarterly measure of wage inflation and labour cost movements in Australia.Key points:

- released by the Australian Bureau of Statistics (ABS) on a quarterly basis

- covers changes in salary and wage levels for various industries and occupations (construction, manufacturing, retail, health care, education, and more)

- covers both the public and private sectors, including full-time and part-time employees

- measures changes in base salary and wage rates, excluding bonuses, overtime payments, and other additional payments. It focuses on the underlying regular wage movements

- The WPI is used by policymakers, economists, and businesses to monitor wage growth trends and assess labor market conditions. It provides insights into the dynamics of wage inflation and can be an indicator of changes in living standards, workforce productivity, and the overall health of the economy.

Its of special note to the folks at the Reserve Bank of Australia (RBA), as it helps inform their decisions on monetary policy.

- Rising wage growth can lead to increasesed consumer spending and potentially contribute to inflationary pressures in the economy.

AUD/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account