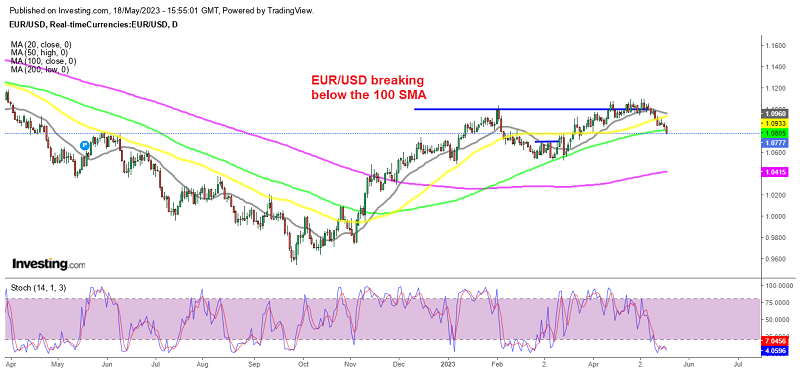

EUR/USD Breaks Below the 100 SMA on Hawkish FED Rhetoric

EUR/USD was looking very bullish until early this month as buyers were testing 1.11, but now it has slipped below 1.08 as USD buyers return

EUR/USD has been bearish since October last year and by the end of the year it -ushed above all moving averages on the daily chart, which then turned into support. The 100 SMA (green) has been the ultimate support indicator, as it held the retreat in March during the banking crisis.

But it seems like this moving average might be broken now. Sellers pushed the price below 1.08 yesterday, breaking below this moving average which opens the door for 1.05 lows. EUR/USD continued to slide lower for the third consecutive day yesterday, to reach new lows around 1.0780. This decline is driven by the strengthening of the USD and despite risk sentiment being positive yesterday caused by positive comments surrounding the US debt ceiling issue which pushed stock markets higher, the USD also remained bullish. Speculation of a potential pause by the Federal Reserve in June, which has now diminished, is also contributing to the bullish momentum in the USD. Below are the comments from FED’s Logan yesterday which hinted at yet another rate hike.

Text from Dallas FED President Logan

- Data at this time does not support skipping a rate hike at the next meeting in June

- Data incoming weeks could yet show that it is appropriate to skip a meeting

- As of today, we are not there yet

- The Fed still has work to do in achieving its goal of price stability

- It is a long way from here to 2% inflation

- She pointed out that the core PCE price index ran a 4.9% annualized pace in the 1st quarter. That was higher than the 4.4 pace in the 4th quarter of 2022

- Keeping an open mind ahead of the meeting

- She is concerned about whether inflation is falling fast enough

- Says Fed has not made enough progress toward 2% target

- Inflation is much too hard

- Restoring price stability is a critical priority

- Labor market has called an economy that is less out of bounds

- Recognizes arguments against tightening policy too much or too fast

- Effect of banking stress affects so far is comparable to a 25 – 50 basis point Fed policy rate increase

- Every bank in the US it should be fully set up at Fed’s discount window and run regular tests

Logan is a voting member of the FED this year. The market is pricing in a 26% of a 25 basis point hike at the June meeting. The FED has so far raised rates by 500 basis points (5%).

On the other hand, the Euro was further weighed down by a more cautious tone from ECB policymakers yesterday. Vice President L. De Guindos stated earlier in the session that the bank has already completed most of its tightening cycle. Another ECB member, A. Müller, dismissed the idea of interest rate cuts as early as 2024.

With no notable data releases in the Eurozone today either, the market focus shifts to the US data. Initial Jobless Claims yesterday increased by 242,000 in the week ending May 13, and the Philly Fed Manufacturing index improved to -10.4 in May. Additionally, Existing Home Sales decreased by 3.4% month-on-month in April (4.28 million units), and the CB Leading Index contracted by 0.6% month-on-month in April.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account