Crude Oil Facing the 200 SMA After Climbing $3 Off the Lows

Crude Oil is testing the 200 SMA again this week, but buyers seems unable to push the price above it today

Today, crude Oil prices saw a decent increase, following the release of the weekly report by the Energy Information Administration (EIA). According to the report, there was a decline in crude Oil inventories of almost 00,000 barrels for the week ending June 9. In the previous week, there had been an inventory build of 4.5 million barrels, which had pushed prices lower.

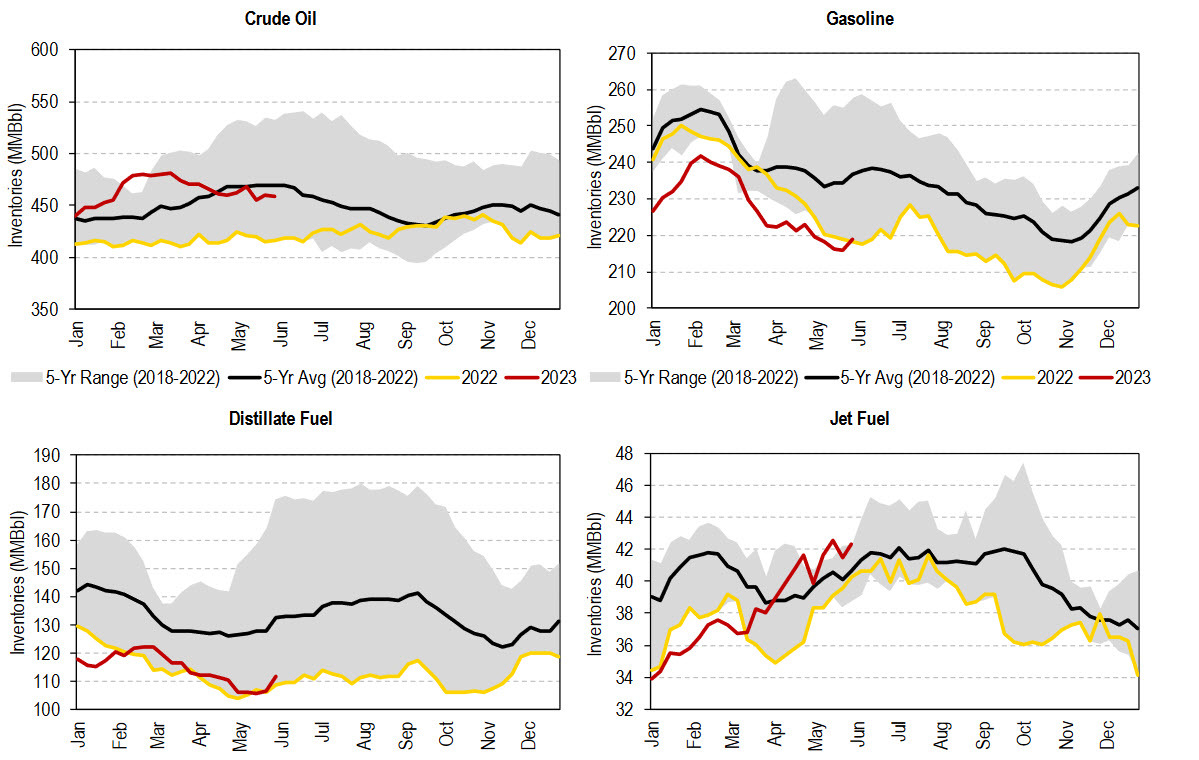

The current level of U.S. crude oil inventories stands at 459.2 million barrels, approximately 2% below the five-year average for this time of the year, as stated by the EIA. Regarding fuels, the EIA’s estimates indicated inventory builds across all categories.

During the reporting period, gasoline stocks increased by 2.7 million barrels. This is in contrast to the previous week, when there was a drawdown of 200,000 barrels.

In terms of oil prices, they initially experienced a decline starting on Monday after a rapid increase following the recent announcement of production cuts by OPEC+. However, later in the day, the prices reversed the downward trend. At the moment, Brent crude is being traded at $77.10 per barrel, while WTI is around $72.60 per barrel. Both prices showed an increase of more than a percentage point compared to their opening values. U WTI tested the 200 SMA (purple) on the H4 chart during the bullish move, but it has failed once again, so this might be a good time to sell Oil here.

Crude Oil H4 Chart – The 200 SMA Holding for Now

Can buyers push Oil above the 200 SMA?

Weekly US Petroleum Inventory Report

- US Oil inventories -451K vs +1,022K expected

- Prior week inventories were +4,488K

- Gasoline +2,746K vs +880K expected

- Distillates +5,057K vs +1,328K expected

- Refinery utilization +2.7% vs +0.6% expected

- Production estimate 12.4 mbpd

Refineries ran hard last week in an attempt to build product inventories ahead of driving season.

API data released late yesterday:

- Crude -1710K

- Gasoline +2417K

- Distillates +4500K

The SPR released 1.8 million barrels last week with mandated sales continuing through month-end (and then nothing scheduled until 2026). WTI was at the highs of the day at $72.86 just ahead of the release. Here are inventory levels, via CIBC. You can see gasoline and distillates very low, similar to last year.

US WTI Crude Oil Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account