Gold Price Shows Indecision as Bullish Sentiment Persists

The GOLD Price (XAU/USD) continues to lack clear direction despite sustained bullish momentum for the second consecutive week. The sluggish market conditions stem from a lack of Federal Reserve (Fed) talks and significant upcoming data releases. China’s upbeat PMI data clashes with mixed foreign trade numbers, while the recent speculation of a July Fed rate hike poses a challenge for Gold buyers.

Meanwhile, the GOLD bulls remain on the table, supported by increased US Treasury bond issuance and cautious optimism surrounding China, along with no rate hike expectations from the June FOMC meeting.

Key Levels to Watch for Gold Price

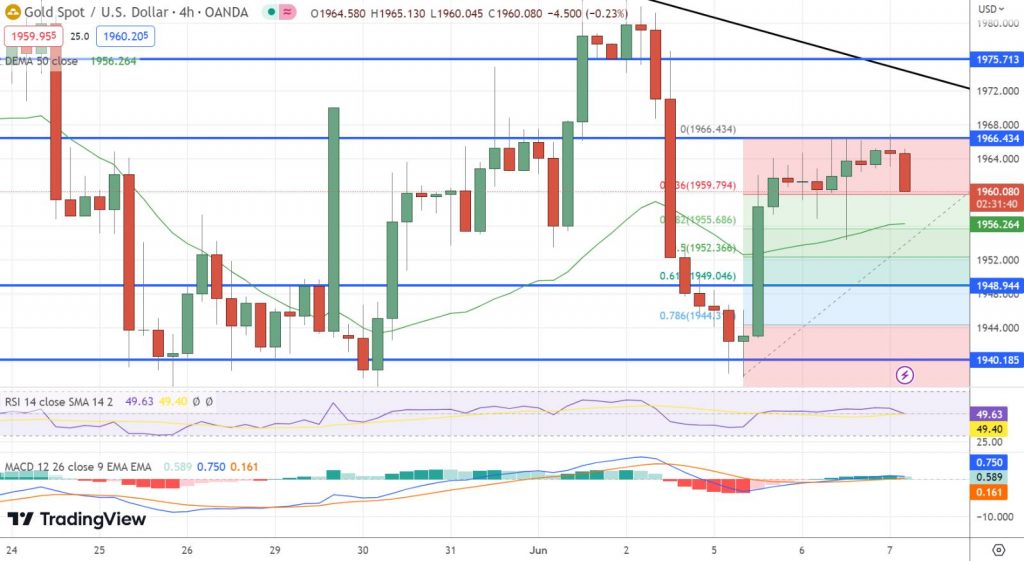

The GOLD Price faces a cluster of resistance levels around the $1,970 mark, as indicated by our Technical Confluence Indicator. This includes the convergence of the Fibonacci 38.2% on a weekly basis, multiple short-term moving averages, and the middle band of the Bollinger on the 15-minute chart, highlighting $1,966 as the immediate upside hurdle.

Further ahead, important resistance lies at $1,968, marked by the Pivot Point one-day R1, upper band of the Bollinger on the hourly chart, and the Fibonacci 23.6% on a monthly basis.

If the quote manages to break above $1,968, the round figure of $1,970 acts as an additional filter before targeting the previous weekly high and the upper band of the Bollinger on the four-hour chart, around $1,985.

Conversely, immediate support can be observed at $1,955, indicated by the 200-hour moving average (HMA), 10-day moving average (DMA), and Pivot Point one-day S1. Further downside potential lies at $1,952, near the Fibonacci 61.8% on a weekly basis, which could attract Gold sellers.