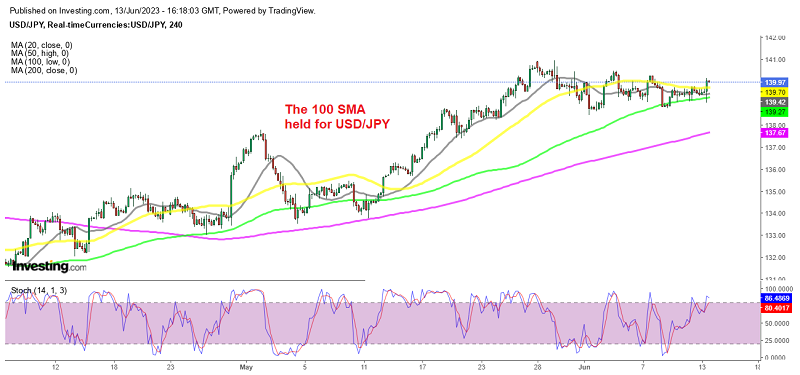

Buyers Remain in Control in USD/JPY As It Bounces off the 100 SMA

USD/JPY found support at the 100 SMA in the last few days and today it jumped to 140 despite a soft US CPI report

Earlier today the US CPI consumer inflation report was released, which leaned on the soft side, although core inflation continues to move higher, after the core CPI ticked up to 5.3% in May. The USD dipped lower against most currencies, but it rallied around 100 pips higher against the Yen.

So. the market is still uncertain about the FED decision tomorrow and the situation indicates a complex interplay of factors influencing the movement of the US dollar and other financial instruments. Here’s a breakdown of the key points:

- Soft CPI Report: The US dollar initially fell in response to a weak Consumer Price Index (CPI) report. CPI is a measure of inflation, and a soft report suggests lower inflationary pressures. Lower inflation can weaken a currency as it reduces the attractiveness of holding assets denominated in that currency.

- Rebound in the Dollar: Despite the initial fall, the US dollar has rebounded. This resurgence is attributed to an increase in Treasury yields. When yields rise, it makes the currency more attractive for investors seeking higher returns.

- Dovish Details of the Report: Although the CPI report initially weakened the dollar, the details of the report are considered dovish. The core CPI, which excludes volatile items like food and energy, was driven by used cars and is expected to reverse in the future. A dovish report suggests that the overall inflationary pressures might not be sustained, which can have a negative impact on the currency.

- Market’s Focus on Future Inflation: The market might be shifting its focus to future inflation trends and the possibility of it remaining persistent (sticky). This shift in thinking could explain the dollar’s rebound despite the dovish CPI report. Factors such as the rise in oil prices, which can contribute to inflationary pressures, might be influencing this perspective.

- Rotation to Value Stocks: In the equity market, there seems to be a rotation from growth stocks to value stocks. This rotation often involves investing in non-US stocks, indicating a shift in sentiment towards global growth prospects. The rate cut by China could be seen as a positive factor influencing this sentiment.

In summary, the market is experiencing a nuanced situation where various factors, including the CPI report, Treasury yields, inflation expectations, oil prices, and equity market rotations, are influencing the movement of the US dollar and shaping market sentiment. USD/JPY found support at the 100 SMA (green) on the H4 chart and now the price is touching the 140 level again.

USD/JPY Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account