Looking to Buy the Retreat in GBP/USD, EUR/USD As ECB Keeps Buyers in Control

We just opened a buy GBP/USD signal and are looking to buy EUR/USD as Bank of England and the ECB remain hawkish

Today it has been pretty quiet, with markets tilting slightly toward the USD earlier in the European session. Global shares experienced a slight decline from the 14-month highs last week. It seems like investors were eagerly awaiting testimony from Jerome Powell, the Chair of the FED, in a market that is currently heavily influenced by expectations regarding monetary policy. Although, I don’t see much change from his last comments in the press conference following the FOMC meeting two weeks ago.

On another front, there are expectations that the Bank of England (BoE) will raise interest rates to their highest level in 15 years this week. This anticipation is fueled by persistently high inflation, which is currently more than four times the BoE’s target. As a result, the British pound has been quite bullish this month, despite the slight retreat today.

According to money markets, there is now a 75% probability that the BoE will choose to raise rates by 25 basis points (bps), and a 25% chance of a larger hike of 50 bps. So, we’re looking to buy GBP/USD soon, as well as opening a buy EUR/USD signal. The ECB remains quite hawkish as today’s comments by ECB members indicated, while the Spanish central bank raised 2023 GDP estimates to +2.3% from +1.6%.

Spanish Central Bank GDP Projections

- 2023 GDP estimate revised up to +2.3% from +1.6%

- 2024 GDP seen at 2.2%

- 2025 GDP seen at 2.1%

- Cuts 2023 inflation forecast to 3.2% from 3.7%

- Sees 2023 budget deficit at 3.8% of GDP from 4.8% in 2022

- Sees debt-to-GDP at 109.7% and easing to 108.0% by 2025

These are decent numbers by the standards of 2023-2025 globally. ECB’s Lane appeared a while ago saying that another rate hike in July seems appropriate and then we will see in September. He added that it is anticipated that inflation will decrease relatively rapidly over the next couple of years, eventually reaching the European Central Bank’s (ECB) target of 2%.

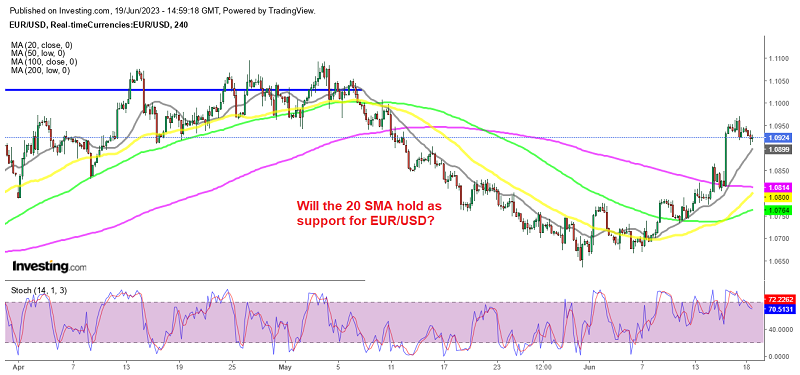

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account