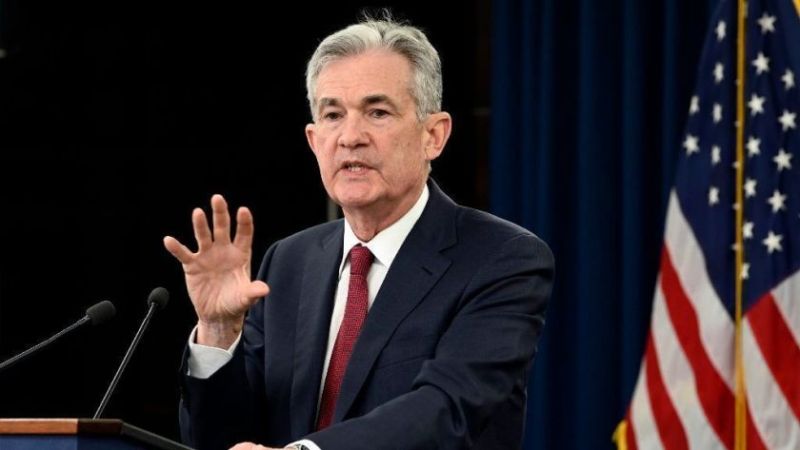

Forex Signals Brief June 22: USD Lower After Powell’s First Day of Testimony

The USD has been in slight demand ahead of Powell's testimony with markets fearing hawkish remark, but he sent the USD lower yesterday

Yesterday’s Market Wrap

Yesterday markets were concentrated mostly on the testimony from the FED chairman Jerome Powell at the US congress which started in the evening. Although before that we had some important data, starting with the consumer inflation numbers form the UK, which showed that the CPI remained unchanged at 8.7% YoY last month, against expectations of another cooldown to 8.4%.

Nonetheless, the GBP ended up lower across the board. After that the retail sales from Canada showed a decent jump in April. As a result, USD/CAD continued lower during this bearish momentum, helped by Powell’s remarks later on. His comments were less hawksih than markets were fearing, which led to a selloff in the USD.

Today’s Market Expectations

Today powell’s testimony will be closely watched by traders again, although we have some major events ahead of that. The Swiss National Bank raised interest rates by 25 basis points to 1.75% which a hawkish outlook despite inflation being low in Switzerland and cooling off already. The Bank of England will follow with a similar hike later on, which would take the bank rates to 4.75%. Then the US unemployment claims will be released, before Powell second day testimony.

Forex Signals Update

Yesterday the price action picked up as the volatility increased, with the USD gaining momentum. We were caught on the wrong side and had four losing signals, but then adjusted the trading strategy accordingly and had three winning forex signals to close the day.

GOLD Closes Below the 100 SMA

Gold has been experiencing a period of fluctuation for more than a month which seems to be continuing, despite the break of the 100 SMA on Wednesday. The price has been mostly oscillating between two moving averages but the 100 SMA (green) was broken this week. yesterday buyers tried to continue lower, but we saw a reversal after Powell’s comments.

XAU/USD – Daily chart

Selling AUD/USD at the 50 SMA

AUD/USD turned bearish earlier this month after buyers had been in total control, with the USD retreating. The 50 SMA (yellow) was acting as support, keeping the trend bullish although we saw a retreat below this moving average and yesterday we decided to open a sell AUD/USD signal below the 50 SMA.

AUD/USD – 60-minute chart

Cryptocurrency Update

BITCOIN Pushes Above Moving Averages

Bitcoin continued its downward movement last week falling below $25,000 briefly.But this week we have seen a bullish reversal and Bitcoin headed for the 50-day Simple Moving Average (SMA), represented by the yellow line on the chart encountered. Yesterday buyers piushed the price above thie 50 SMA and the 100 daily SMA (gren) so the bullish trend is back on.

BTC/USD – Daily chart

ETHEREUM Hesitating to Move Higher

ETHEREUM made a break of the resistance and support area above $1,700 as the price fell below $1,630s, but the 200 SMA (purple) was waiting there, which stopped the decline. This moving average acted as support on the daily chart, and the price formed a doji candlestick above it, which is a bullish reversing signal, followed by a nice bullish candlestick on Friday. We decided to open a buy Ethereum signal but the price has been trading in a tight range in the last several days.

ETH/USD – Daily chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account