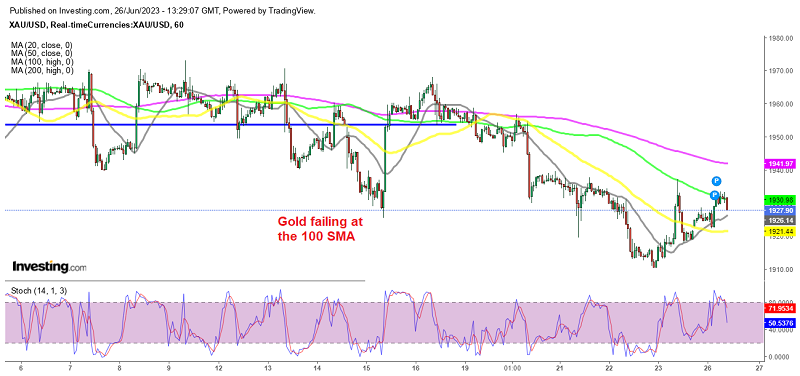

Selling the Retrace in Gold at the 100 SMA Again

Gold has been trying to push higher, but the 100 SMA has been stopping the climb, providing good selling opportunities

Gold was trading sideways in a range for more than a month, until last week when it resumed the decline. On the daily chart, it is evident that Gold experienced a breakout below the significant support zone around 1934, falling to $1,910. Following the breakout, XAU/USD retraced higher to the 100 SMA (green) on the H4 chart, which has now turned into a resistance indicator.

Sellers seem to be taking advantage of this moving average and the selling pressure up there has increased, anticipating further downside movement. On Friday last week, we decided to open a sell Gold signal at this moving average, which closed in profit after the rejection by it. Today, we saw another retrace higher, which seemed weak as the climb was pretty slow, so we decided to open another sell Gold signal at this moving average. That moving average rejected the price again just a while ago and we booked profit on another winning Gold signal.

The fundamentals are also pointing down for Gold. The blackout period, which restricted public comments from Federal Reserve members, ended last week. Since then, we have started to hear remarks from several FED officials. The prevailing sentiment among them continues to be one of patience, with a reliance on incoming data to determine the appropriate course of action for further tightening of monetary policy. While a majority of officials anticipate two additional rate hikes this year, they consistently emphasize that the final decision will depend on the data.

The data released last week appears to support the possibility of a rate hike. The housing market data exceeded expectations, US Jobless Claims remained at a solid level, and the US Services PMI surpassed forecasts. The upcoming reports on Non-Farm Payrolls (NFP) and Consumer Price Index (CPI) will undeniably play a crucial role in shaping future expectations. However, if the incoming data continues to be positive, we can expect the Fed to raise rates in July, which aligns with the current market expectations.

Gold XAU Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account