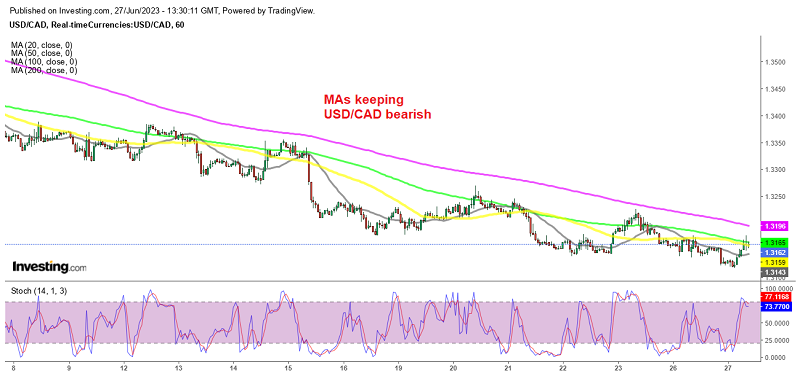

Where Is USD/CAD Headed After CPI Figures

USD/CAD has been bearish all this month, losing more than 500 pips

The Canadian Dollar has had an impressive performance in recent weeks, particularly against the US Dollar. This is noteworthy considering the decline in crude Oil prices, which typically have a strong correlation with the CAD, but the CAD is following the Bank of Canada this time.

While attention has been focused on the rate paths of other major central banks, such as the US Federal Reserve and the European Central Bank, the Bank of Canada (BoC) has somewhat slipped under the radar. However, last week, the minutes by the BOC from the June meeting revealed discussions regarding the rate hike implemented in June, along with indications of a potential further hike in July. The BOC expressed surprise at the strength of the economy, noting resilient household consumption and persistent price pressures across various sectors.

So, now the market is pricing in a 25 basis points hike in July, and this week’s data from Canada is likely to be crucial in assessing the economic landscape. The release of May’s inflation data, especially in light of persistent price pressures experienced in other developed economies like the UK, was closely watched. Additionally, the GDP report for April, which is expected to show a 0.2% growth after falling flat in March, will be released on Friday will also be important. If inflation and weekly earnings show an increase, it could support the CAD as rate hike expectations are likely to be adjusted in a more hawkish direction. As we approach the third quarter, there is much to analyze and consider for the Canadian Dollar.

Canada CPI Inflation Report for May

- May CPI 3.4% y/y versus 3.4% expected

- Lowest reading since June 2021

- Prior was 4.4%

- CPI m/m +0.4% vs +0.5% expected

- Prior m/m reading was 0.7%

- Gasoline prices -18.3% vs -7.7% y/y in prior month

- Gasoline prices -0.8% m/m vs +6.3% prior month

- Ex gasoline +4.4% vs +4.9% prior

- Food +8.3% vs +9.1% y/y prior

- Mortgage interest costs 4.9% y/y vs 4.9% increase in April

- Goods inflation +2.1% y/y

- Services inflation +4.9%

Core measures:

- BOC core y/y 3.7% vs 3.9% expected (prior 4.1%)

- BOC core m/m +0.4% vs +0.5% prior

- Median 3.9% vs 4.2% prior

- Trim 3.8% vs 4.2% prior

- Common 5.2% vs 5.7% prior

This is the final CPI print ahead of the July 12 Bank of Canada rate decision. Ahead of the release, the market was placing a 65% probabilty on a 25 bps rate hike and that ticked to 62% afterwards. I maintain that the BOC is making a mistake in hiking further rather than simply letting high rates do their thing to a heavily-indebted Canadian consumer.

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account