ECB Keeping the Euro Bullish Despite Slowing Economy

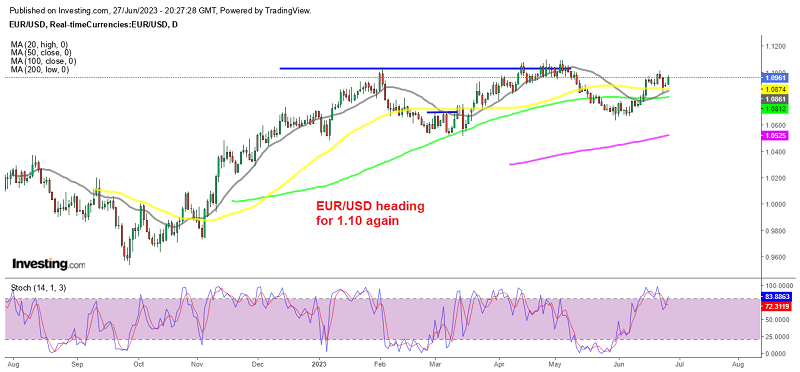

EUR/USD lost 200 pips in the last two days of last week, but MAs held as support and this week we are seeing a bullish reversal

Today we have a number of the heads of central banks holding speeches at the ECB forum in Sintra, although the speech from the head of the European Central Bank itself is not listed as too important, since everyone already knows their position; they’re continuing to raise interest rates. Yesterday Christine Lagarde delivered some comments, which reinforced the hawkish bias.

Remarks by ECB President, Christine Lagarde

- Inflation remains too high

- We are committed to reaching inflation target come what may

- We cannot waver, cannot declare victory yet

- Need to bring rates to “sufficiently restrictive” territory

- Need to communicate clearly that we will stay at those levels for as long as necessary

- Have not yet seen the full impact of the cumulative rate hikes since last July

- Not likely to say with full confidence that rates have peaked

In essence, her hawkish remarks here are brushing aside the setback seen in the economic data since the end of last week. But as mentioned earlier, the ECB can’t show signs of weakness just yet – not least when they still have one more rate hike to go in July at the minimum.

Last week EUR/USD was bullish while other risk currencies were retreating against the USD and this pair peaked above 1.10. But, eventually, it turned lower as well, losing around 2 cents in the last two days. Although, the 20 SMA (gray) held as support on the daily chart and this pair started to reverse.

On the daily chart, we observe that EUR/USD managed to recover from its weakness in May and experienced a rally back toward the 1.10 level in June. However, the price encountered strong resistance at that level, leading to a significant decline triggered by disappointing European PMI data. Currently, the overall trend remains bullish as the moving averages are still showing an upward crossover, and the price has been forming higher highs and higher lows. However, the momentum appears to be weakening, and if the economic data for the Eurozone continues to disappoint, it is possible that we may witness a potential top formation in this area. So, the data will be more important than Lagarde’s talk later today, since she will be repeating the same rhetoric.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account