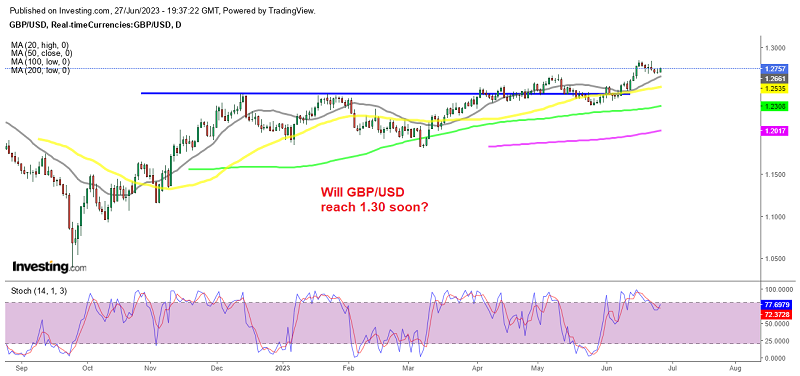

Is GBP/USD Resuming Uptrend As UK Inflation Stays High?

GBP/USD was retreating down last week, but it is making a bullish reversing pattern so the trend might change this week

GBP/USD turned bullish in October last year, after crashing down to 1.03 lows during September. UK financial institutions intervened and this pair started a bullish trend, which is still ongoing, with the USD also helping a lot since it has been retreating since October. Earlier this month GBP/USD almost reached 1.285o, before retreating lower last week.

Although, on Monday the daily candlestick closed as a doji which is a bullish reversing signal after the retreat and yesterday the candlestick looked bullish, as this pair gained around 50 pips. Fundamentals are sort of mixed in the UK. We saw some reports suggesting that the UK government will not implement the recommendations of the pay review body regarding public sector wage increases. This decision comes as the country continues to grapple with high inflation.

John Glen who is the Chief Secretary to the Treasury stated that the government needs to take inflation into account and expressed concerns that increasing public sector wages could make the ongoing inflation issue worse. This development raises the question of whether the UK may face further public sector strikes if a resolution is not reached.

The public sector wage dispute is not the only challenge facing the UK. Chancellor Jeremy Hunt has also had to backtrack on proposed tax cuts. Hunt cited the risks of inflation as the primary reason for this decision, as tax cuts could potentially stimulate higher demand and consumption. That wouldn’t be so bad on the other hand, since it would help the slowing economy. Last week manufacturing fell deeper into recession while services also weakened.

But, inflation remains stubbornly high, as it jumped to 8.7% year-on-year in May, as last week’s report showed. Besides that, the Bank of England (BOE) delivered a 50 basis points (bps) rate hike, beating expectations of a 25 bps hike, which gave the GBP a push, but it didn’t last long, as the USD buyers returned again and the retreat resumed. Today we have Jerome Powell, as well as BOE Governor Bailey holding speeches at the ECB forum in Sintra, so we might see some volatility in GBP/USD.

GBP/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account