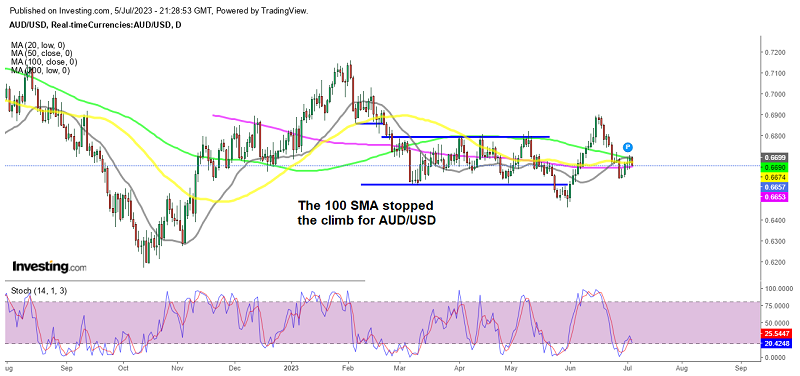

AUD Fails at the 100 SMA, As China Shows Signs of Further Slowdown

AUD/USD continues to make lower highs despite the recent rally, which failed at the 100 SMA and we saw a reversal down yesterday

The Reserve Bank of Australia (RBA) held interest rates unchanged at 4.10% in the last meeting after the surprise hike in June, and didn’t give any hawkish signs. Although the AUD has been gaining on the back of a weaker USD, which sent AUD/SUD above 0.67. Although buyers failed to break the 100 SMA and now the price is heading back down after the reversal yesterday.

The Australian dollar was currently at a crucial turning point against the US dollar Although the release of two significant economic indicators, namely the Australian PMI (Purchasing Managers’ Index) and the Chinese Caixin PMI. Unfortunately, which fell short of estimates, underscoring the growing concerns about a global recession as tight monetary policies are implemented sent the AUD lower. The Ai Group Industry Index, which measures changes in activity for the industrial sector, has also declined, indicating a deeper negative contraction.

So, as services start showing signs of weakness in China, the Australian dollar is likely to face selling pressure due to its close trading relationship with China, especially considering China’s “pro-growth” stance and the strong positive correlation between the Australian dollar and the Chinese economy. The prices of major Australian commodities were also experiencing downward pressure due to the slightly stronger US dollar and the weakened economic conditions in China. The FOMC (Federal Open Market Committee) minutes heled the situation further for the USD while risk assets slipped lower, so a bearish reversing pattern is forming in AUD/USD.

China Caixin / S&P Global PMIs for May:

- Caixin services 53.9 points vs 57.1 prior, sixth consecutive month of expansion

- Composite services 52.5 points vs 55.6 prior

Earlier in the week we had the Caixin manufacturing PMI, dropping from May but still in in expansion:

- China June 2023 Caixin / S&P Global Manufacturing PMI 50.5 (prior 50.9)

And, last week were the official PMIs from the National Bureau of Statistics (NBS) survey:

- China June PMIs: Manufacturing 49.0 (expected 49.0) & Services 53.2 (expected 53.7)

China has two primary Purchasing Managers’ Index (PMI) surveys – the official PMI released by the National Bureau of Statistics (NBS) and the Caixin China PMI published by the media company Caixin and research firm Markit / S&P Global.

While the NBS’ PMIs cover large and state-owned companies, the Caixin PMI survey covers more small and medium-sized enterprises. As a result, the Caixin PMI is considered to be a more reliable indicator of the performance of China’s private sector. Another difference between the two surveys is their methodology. The Caixin PMI survey uses a broader sample of companies than the official survey. Despite these differences, the two surveys often provide similar readings on China’s manufacturing sector.

Commentary on the Composite PMI, in brief:

- Production, demand, exports and employment all expanded, but at a mild pace

- A slew of recent economic data suggests that China’s recovery has yet to find a stable footing, as prominent issues including a lack of internal growth drivers, weak demand and dimming prospects remain

- In June, Caixin China PMIs showed that conditions in the manufacturing sector lagged far behind services. Employment contracted, deflationary pressure mounted, and optimism waned in the manufacturing sector. Meanwhile, the services sector continued a post-Covid rebound, but the recovery was losing steam.

AUD/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account