GBP/USD Gains Traction, Supported by Softening Fed Outlook and Positive Risk Sentiment

The GBP/USD pair sparks buying interest during the Asian session, signaling a potential pause in its recent corrective decline from last week's peak near the 1.3140 region.

•

Last updated: Tuesday, July 18, 2023

The GBP/USD pair sparks buying interest during the Asian session, signaling a potential pause in its recent corrective decline from last week’s peak near the 1.3140 region. Although spot prices face resistance and retreat slightly from the 1.3100 mark, optimism prevails as traders reassess the Fed’s monetary policy stance and anticipate strong inflation-curbing measures by the Bank of England (BoE).

Speculation that the Federal Reserve will adopt a less hawkish approach, keeping interest rates steady after the anticipated July increase, weighs on the US Dollar. This, coupled with a positive risk sentiment, puts downward pressure on the safe-haven Greenback, giving the GBP/USD pair room to regain positive momentum. However, expectations that the Fed might still proceed with a 50 basis point rate hike this year temper the pair’s gains.

Amidst these conflicting factors, the downside for the GBP/USD pair finds support from growing confidence in the BoE’s commitment to tackling persistent inflation. Market focus remains fixated on the release of the UK’s consumer inflation figures, which will provide meaningful insights and direction for the British Pound. In the short term, traders will also monitor the US monthly Retail Sales data for potential trading opportunities.

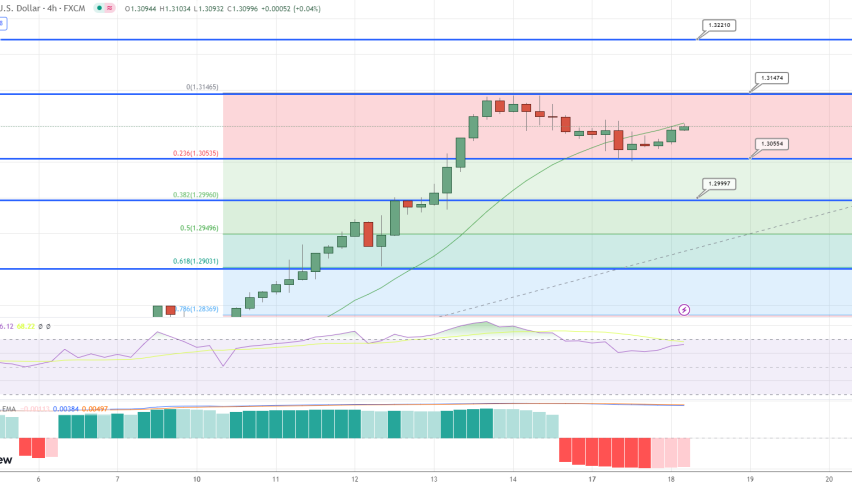

From a technical standpoint, the recent breakout above the resistance level defined by an ascending channel is viewed as a bullish signal. Although the Relative Strength Index (RSI) indicates slightly overbought conditions, the fundamental backdrop supports the path of least resistance being to the upside. Pullbacks could present attractive buying opportunities as the GBP/USD pair seeks immediate support around the 1.3050 level and looks to breach the psychological level of 1.3100 for a substantial intraday upward move.

While caution remains in the market, a sustained break above the 1.3100 mark could propel the pair towards its multi-month peak around 1.3140. Further buying pressure may pave the way for a potential climb towards the 1.3200 mark, followed by the intermediate hurdle of 1.3250-1.3260. These levels present significant targets, reflecting the potential for an extended upward trajectory.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Arslan Butt

Lead Markets Analyst – Multi-Asset (FX, Commodities, Crypto)

Arslan Butt serves as the Lead Commodities and Indices Analyst, bringing a wealth of expertise to the field. With an MBA in Behavioral Finance and active progress towards a Ph.D., Arslan possesses a deep understanding of market dynamics.

His professional journey includes a significant role as a senior analyst at a leading brokerage firm, complementing his extensive experience as a market analyst and day trader. Adept in educating others, Arslan has a commendable track record as an instructor and public speaker.

His incisive analyses, particularly within the realms of cryptocurrency and forex markets, are showcased across esteemed financial publications such as ForexCrunch, InsideBitcoins, and EconomyWatch, solidifying his reputation in the financial community.