EUR/USD Struggles for Momentum Above 1.1200 Level Amid Mixed ECB Signals

The EUR/USD pair faces challenges in gaining significant traction as it moves within a narrow trading range above the 1.1200 level during the Asian session.

The EUR/USD pair faces challenges in gaining significant traction as it moves within a narrow trading range above the 1.1200 level during the Asian session. Mixed signals from European Central Bank (ECB) officials regarding future policy decisions, coupled with a decline in German yields, have undermined the shared currency.

The US Dollar (USD), meanwhile, fails to capitalize on an overnight rebound, as market participants increasingly expect the Federal Reserve (Fed) to adopt a more dovish stance. This hesitancy prevents bearish bets on the EUR/USD pair and limits the potential extension of the previous day’s modest pullback from the 1.1275 region, which marked the highest level since February 2022.

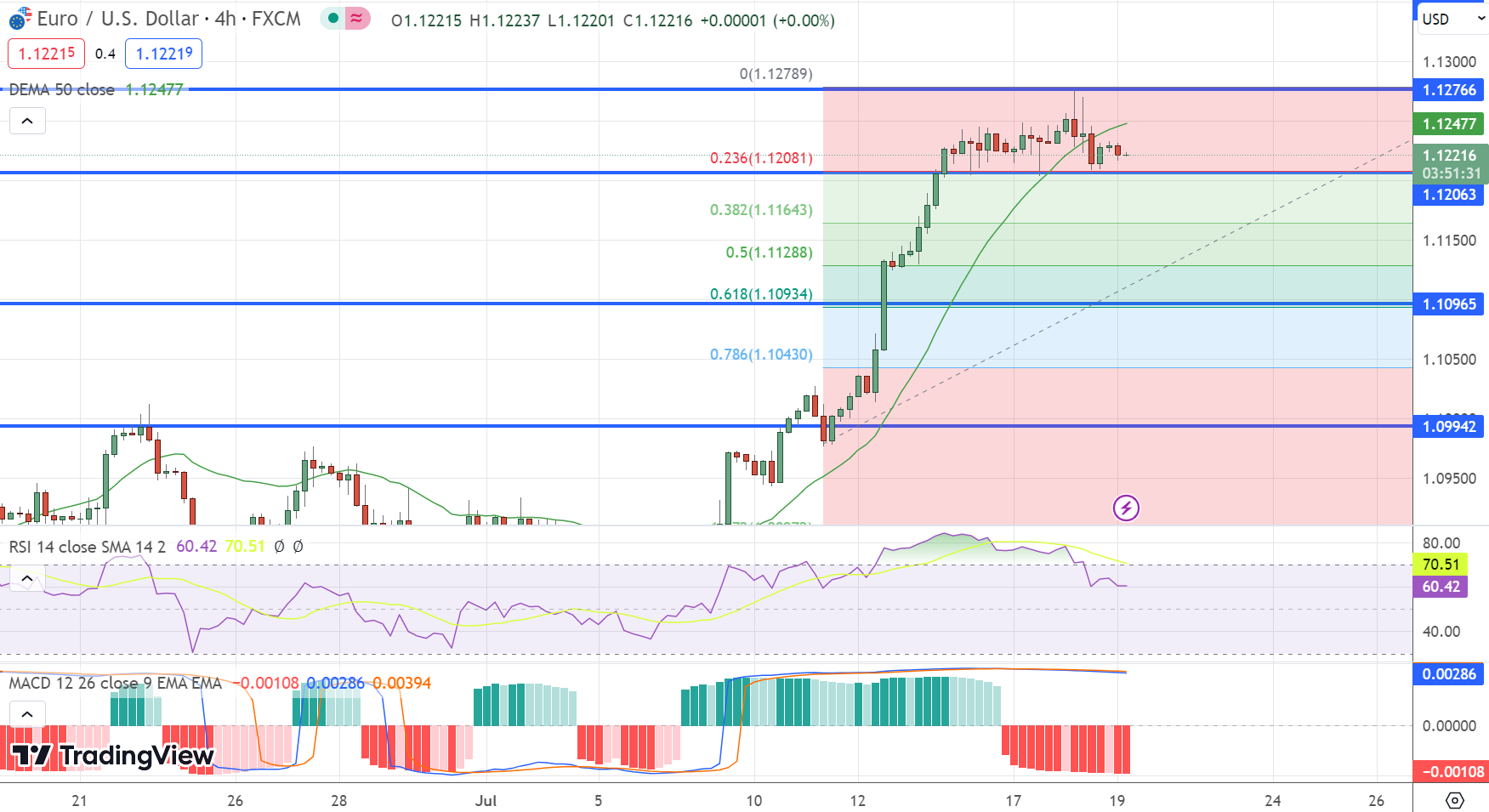

From a technical perspective, the recent price action forms a rectangle pattern on short-term charts after a rally from the 100-day Simple Moving Average (SMA). While the Relative Strength Index (RSI) on the daily chart signals overbought conditions, the overall setup still favors bullish traders and suggests a path of least resistance to the upside. Any subsequent pullback could be viewed as a buying opportunity with limited downside potential.

The immediate downside is expected to find support around the 1.1200 level, and a sustained weakness could trigger technical selling, potentially leading the EUR/USD pair toward the 1.1145 support zone. Further selling pressure might encounter buying interest near the 1.1100 round-figure level, which is anticipated to act as a strong base. A decisive break below this level, however, would negate the short-term positive outlook.

The immediate downside is expected to find support around the 1.1200 level, and a sustained weakness could trigger technical selling, potentially leading the EUR/USD pair toward the 1.1145 support zone. Further selling pressure might encounter buying interest near the 1.1100 round-figure level, which is anticipated to act as a strong base. A decisive break below this level, however, would negate the short-term positive outlook.

On the upside, immediate resistance is seen near the 1.1245-1.1250 region, followed by the multi-month peak around 1.1275. Overcoming these levels would pave the way for a test of the 1.1300 round-figure mark. The next significant hurdle lies near 1.1335, and a successful breach could drive the EUR/USD pair toward the 1.1400 level, with further upside potential towards the 1.1450 regions en route to the psychological milestone of 1.1500, representing the 2022 yearly peak.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account