Where Is the GBP Headed As Consumer Inflation Finally Slows Down?

UK consumer inflation posted a decent decline today, which is bad news for the GBP as it removes the pressure on the BOE to hike rates

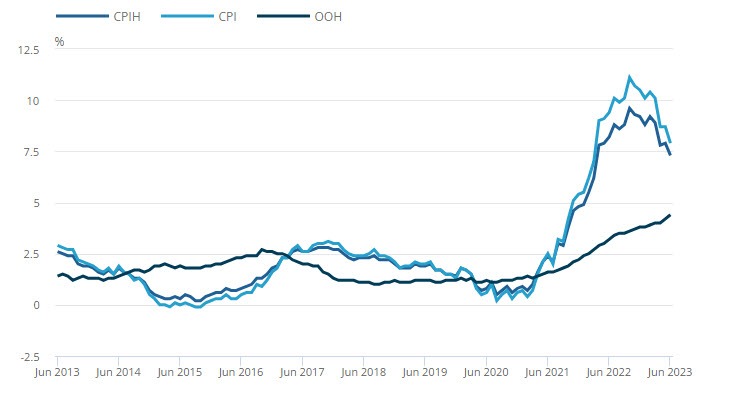

While inflation has been cooling off everywhere since last year, in the UK it continued to remain high, with a sudden jump from 8.2% to 8.7% in May. UK inflation has been outpacing US inflation which is one of the reasons for this pair being quite bullish and climbing around 550 pips in the last three weeks.

The latest CPI and PPI reports from the US showed further moderation in consumer and producer prices in June. The Consumer Price Index (CPI) came weaker than expected, with the headline CPI YoY coming in at 3%, slightly lower than the expected figure of 3.1%. Moreover, this reading represents a significant decline of one percentage point from the previous month’s figure of 4%, so it seems like inflation is heading toward the 2% normal.

On the other hand, UK inflation has not been declining as it has in other countries, but the general statement earlier implies that the rate of inflation in the UK continues to rise at a faster pace than in the US. In June, the pound’s value declined as consumer inflation did not meet the expected estimates. Despite being a downside, this situation can actually be seen as a positive development for the UK economy. It also reduces the Bank of England’s (BOE) strong inclination to adopt an overly aggressive monetary policy (hawkish stance).

Considering the inflation miss, the possibility of a 50 basis points (bps) interest rate hike next month might have to be reconsidered. Instead, it is likely that markets will now anticipate a more modest increase of 25 bps.

UK CPI Inflation Report for June

- June CPI YoY +7.9% vs +8.2% expected

- May CPI YoY +8.7%

- Core CPI YoY +6.9% vs +7.1% expected

- Prior CPI YoY +7.1%

The pound is dragged lower as we see consumer inflation miss on estimates for the month of June. This is a positive development for the UK economy, and it does lead to lesser conviction for the BOE to go too overly hawkish. A 50 bps rate hike next month might have to be relooked, as I would think markets may now start to look towards 25 bps instead.

GBP/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account