EUR/USD Holds Mild Gains Amid Mixed Concerns and US Dollar Weakness

In the latest trading session, the EUR/USD pair managed to cling to mild gains around the 1.1220 level, marking its first daily profits in three days as Thursday's European session began.

•

Last updated: Thursday, July 20, 2023

In the latest trading session, the EUR/USD pair managed to cling to mild gains around the 1.1220 level, marking its first daily profits in three days as Thursday’s European session began. The Euro pair benefited from broad weakness in the US Dollar, despite mixed concerns about the Eurozone’s economic conditions.

Reuters’ analysis highlighted factors such as high inflation and the ongoing Ukrainian conflict, which raised concerns about employment conditions in the Eurozone. Additionally, European Central Bank (ECB) Governing Council member Yannis Stournaras expressed uncertainty about future rate hikes and warned that further increases could harm the economy.

While doubts surround the US economic transition, the EUR/USD remains relatively strong compared to the US Dollar, especially as expectations suggest a potential policy pivot by the Federal Reserve after July, while ECB talks are slightly less dovish.

On the other hand, the US Dollar Index (DXY) retraced 0.25% intraday, testing the key psychological level of 100.00. Despite downbeat US housing data and mixed concerns about the Federal Reserve, the US Dollar ignored the optimism seen in US banks.

Recent comments from Chinese diplomats and the US House of Representatives’ move on outbound investments and AI chips have added to concerns regarding US-China tensions, supporting the EUR/USD bulls.

In terms of market indicators, S&P500 Futures showed mild losses, while US Treasury bond yields traded mixed at weekly lows.

In terms of market indicators, S&P500 Futures showed mild losses, while US Treasury bond yields traded mixed at weekly lows.

Looking ahead, preliminary readings of Eurozone’s Consumer Confidence for July and US Initial Jobless Claims and Existing Home Sales data will be closely watched. However, the focus should primarily be on the risk catalysts that could provide clearer market direction. Stronger-than-expected EU data may help the EUR/USD break above the key resistance level of 1.1280, driven by broad US Dollar weakness. Conversely, weaker data may not attract bears unless US data and sentiment boost the US Dollar.

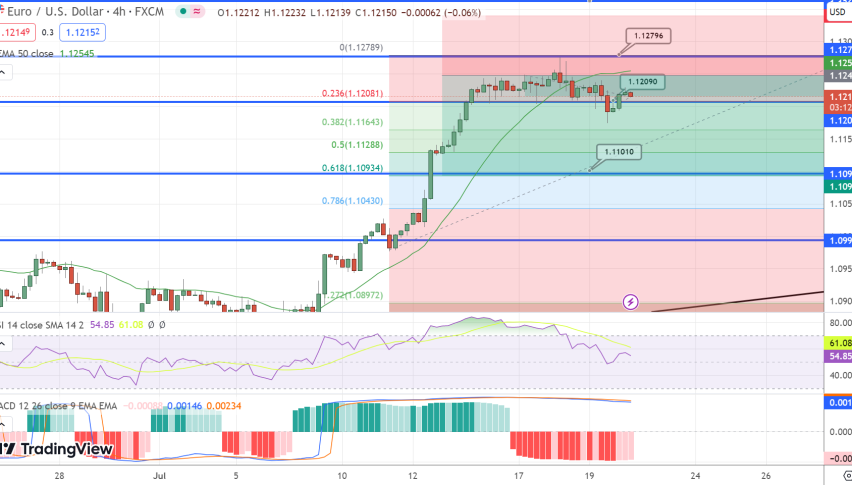

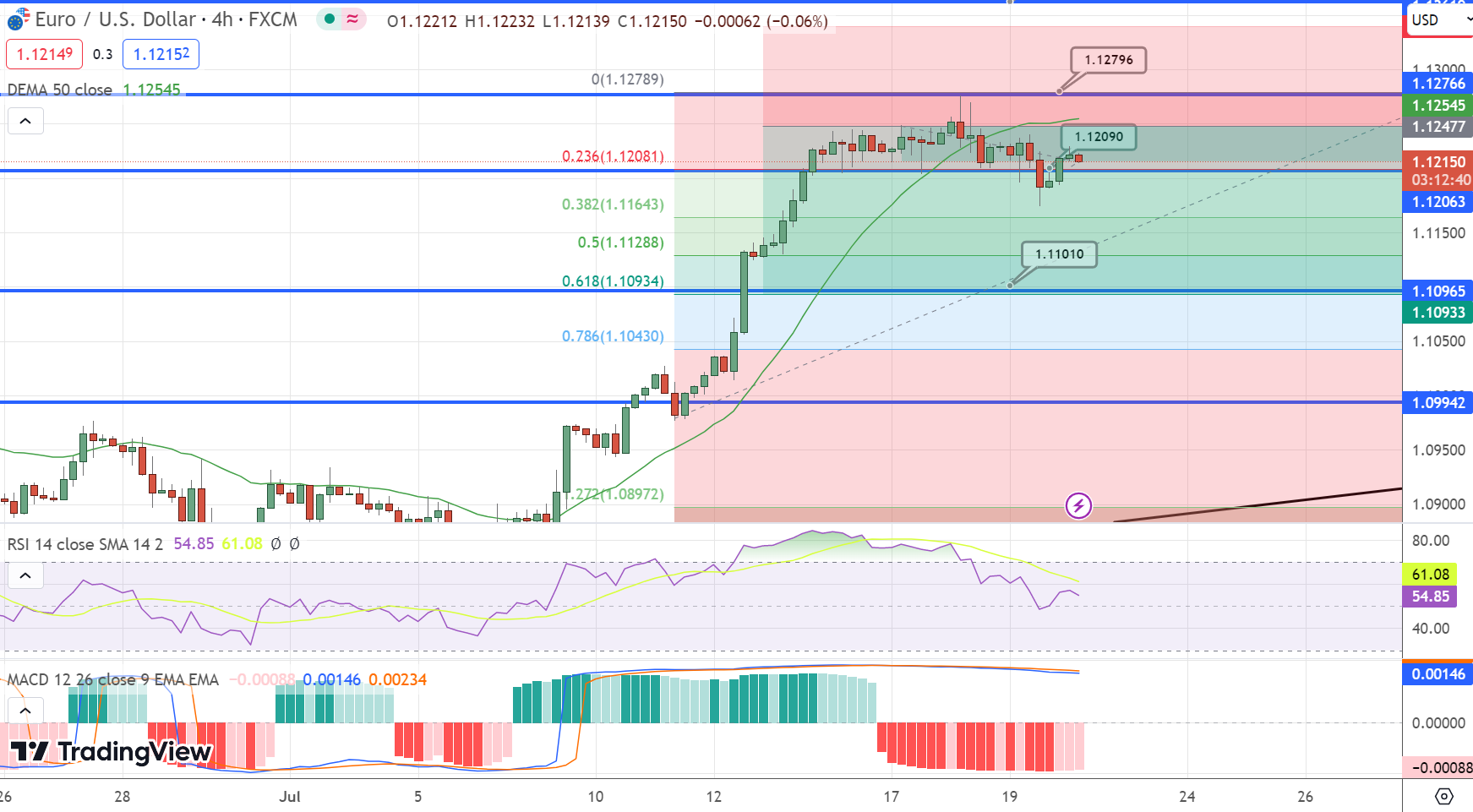

From a technical perspective, the EUR/USD pair’s ability to trade successfully above the 1.1145-40 support confluence, comprising the 10-day moving average and a previous resistance line from February, allows the pair to aim for the 1.1280 resistance zone. However, caution is warranted as the pair faces nearly overbought conditions according to the Relative Strength Index (RSI), posing a challenge to further upside beyond 1.1280.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Arslan Butt

Lead Markets Analyst – Multi-Asset (FX, Commodities, Crypto)

Arslan Butt serves as the Lead Commodities and Indices Analyst, bringing a wealth of expertise to the field. With an MBA in Behavioral Finance and active progress towards a Ph.D., Arslan possesses a deep understanding of market dynamics.

His professional journey includes a significant role as a senior analyst at a leading brokerage firm, complementing his extensive experience as a market analyst and day trader. Adept in educating others, Arslan has a commendable track record as an instructor and public speaker.

His incisive analyses, particularly within the realms of cryptocurrency and forex markets, are showcased across esteemed financial publications such as ForexCrunch, InsideBitcoins, and EconomyWatch, solidifying his reputation in the financial community.