EUR/USD Testing the 50 SMA As USD Gains Momentum

EUR/USD has lost around 70 pips and is facing the 50 SMA as support on the H4 chart, as unemployment claims decline in the US

EUR/USD climbed above the 1.1200 level early today, as the USD went through an air pocked after positive employment numbers from Australia. But buyers couldn’t hold on to gains above that level and this pair reached a peak just below 1.1230 but subsequently retraced, currently trading around 1.1150.

The market mood was negatively affected by escalating tensions between China and the United States (US) over restrictions on China’s chip sector. Besides that, the Eurozone consumer confidence remained well in negative territory.

From a technical perspective, on the H4 chart, the probability of a bearish extension for the EUR/USD pair appears to be significant. This pair faced a decline after making another unsuccessful attempt to move above its 20 Simple Moving Average (gray) earlier today, which is currently acting as dynamic resistance around the 1.1220 level.

Furthermore, the stochastic indicator on the 4-hour chart was showing a sharp decline, almost in a vertical manner, which predicted the bearish move, which came after the decent unemployment claims numbers from the US. This indicates a prevailing near-term selling interest in this pair.

Although, the decline has stalled right at the 50 SMA (yellow) right now, so let’s see what happens. Considering these factors, the 4-hour chart suggests that the EUR/USD pair is likely to experience further downward movement if sellers break below the 50 SMA. In case this moving average holds, we are closely monitor the price action around the 1.1220 level as it acts as a critical resistance, and any failure to breach it could lead to additional selling pressure, so we would be inclined to sell on a bounce up there, after already closing a sell EUR/USD signal in profit.

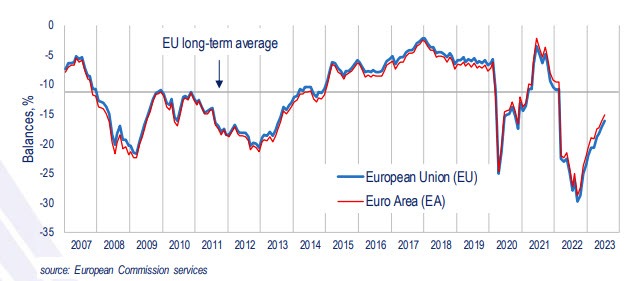

Eurozone Consumer Confidence for July 2023

- Consumer confidence flash for July -15.1 points vs -16.0 estimate

- June consumer confidence -16.1 points

- Consumer confidence in the Euro area flash for July 2023 -15.1 points vs -16.0 estimate

- The EU confidence moved up to -16.1 (up 1.1)

Looking at the chart above, the confidence level is inching higher from 2022 lows. The longer-term average comes in around -11.5. For those looking for a positive number the chart above shows no instances where the price moved above the 0.0 line

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account