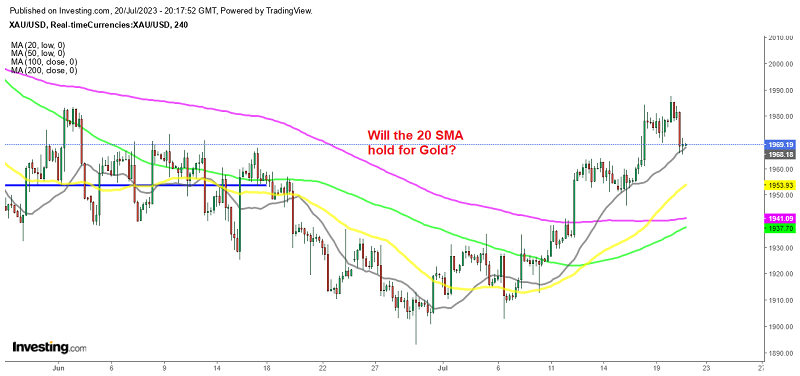

Anyone Else Buying the Retreat in Gold?

Gold retreated around $20 lower yesterday on better US employment figures, but we decided to buy the pullback at the 20 SMA

The US dollar (USD) has been experiencing a bearish trend for a considerable period, and last week, the decline resumed and the pace picked up, sending the USD diving against other major currencies, while risk assets and commodities rose. Gold benefited from this and in the last two weeks, it surged around $50 higher. This was triggered by the release of consumer inflation CPI which indicated another decent slowdown in inflation and producer inflation PPI figures for June, which suggests that inflation will slow down further in the coming months.

The lower-than-expected inflation figures raised doubts about the Federal Reserve’s future monetary policy decisions. As a result, the likelihood of further interest rate hikes by the Federal Reserve following this month’s rate hike diminished. This led to increased investor appetite for risk assets, such as stocks and commodities, and simultaneously pushed the USD lower.

When inflation is subdued, it reduces the urgency for central banks like the Federal Reserve to implement aggressive interest rate hikes as a measure to combat rising prices. Consequently, investors interpreted the data as a signal that the FED might adopt a more cautious approach towards tightening monetary policy, which weakened demand for the USD.

The softer US retail sales and housing figures this week accelerated the surge in Gold although, after experiencing some decent gains earlier in the week, Gold prices reversed direction yesterday, declining by approximately 0.7% to $1,965, briefly piercing the 20 SMA (gray) on the H4 chart. ALthough this moving average has been pierced before and the price climbed back up, to close above it. A doji candlestick formed which is a bullish reversing signal and we decided to shift to long ion Gold, opening a long term buy Gold signal, after having several short term sell signals yesterday.

The decline in XAU/USD was triggered by a surge in U.S. bond yields and the strength of the U.S. dollar, which were both influenced by better-than-expected economic data in the United States. The US unemployment claims decreased to 228,000 from the previous 237,000, surpassing the expected figure of 242,000. This decline in jobless claims marked the lowest level since mid-May, indicating that widespread layoffs are not currently a prevalent concern. This positive economic data drove gold prices lower. Although that’s just one piece of data, so the overall sentiment for the USD remains bearish. Besides that, the 20 SMA continues to hold as support, so we decided to buy the pullback.

Gold XAU Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account