Turning Long in USD/CAD After Soft Retail Sales

The retail sales missed expectations, showing that Canadian consumer is feeling the pressure from higher interest rates, which has turned...

USD/CAD has been bearish since May, making lower highs, although it has been showing some decent buying momentum today. This pair is currently close to the highs of the day, having gained around 50 pips to 1.3220s after the release of the Canadian retail sales report. Before the data release, this pair was already on a bullish course for the day, due to broad strength in the US dollar. After the report was released, which showed a 0.2% month-on-month increase in sales compared to the expected 0.5%, USD/CAD continued to push higher. Additionally, the advance reading for June indicated no change (flat) in retail sales.

It is interesting to note that despite WTI crude oil climbing by more than $1 today, reaching $76.895, which would be the highest weekly close since April, the CAD still remains soft. Markets are now pricing in a 75% chance that the Bank of Canada will hold interest rates unchanged at the September 6 meeting, an increase from the previous 70% probability before the retail sales data release. This suggests that investors are becoming more confident in the likelihood of the BOC keeping rates steady.

The rise in the USD/CAD pair despite the positive oil market performance and the increased probability of unchanged interest rates could indicate that Canadian consumers might be feeling the impact of high rates, as reflected in the retail sales data. So, we ae looking to buy the pullbacks lower on this pair.

Canadian May 2023 Retail Sales Report

- May retail sales +0.2% vs +0.5% expected

- The advance reading was +0.5%

- Prior was +1.1% (revised to +1.0%)

- Ex autos 0.0% vs +0.3% expected (prior was +1.3%, revised to +1.2%)

- June advance reading 0.0%

- Year-over-year sales +0.5% vs +1.4% prior

Coming into this report, core sales had risen for five consecutive months so a flat reading isn’t a big red flag but higher interest rates are undoubtedly starting to bite.

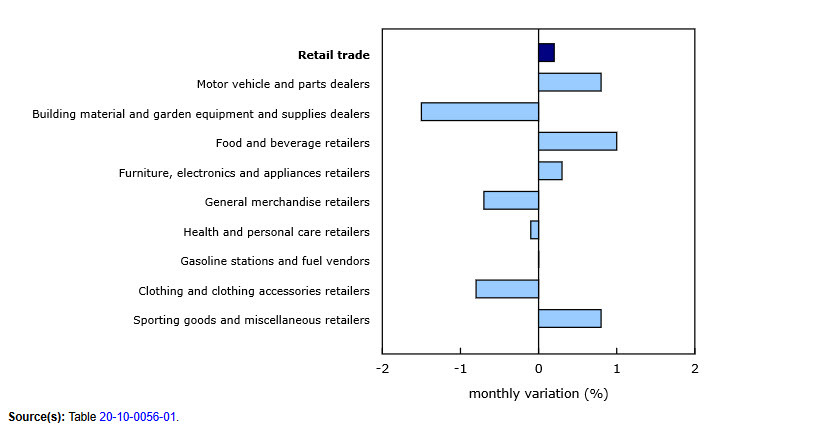

The report offers valuable insights into consumer spending patterns and how the squeeze on consumers is impacting different sectors of the economy. The data indicates a notable 6.9% increase in spending at supermarkets, suggesting that consumers are prioritizing essential items such as groceries. This shift in spending behavior might be a result of economic pressures or uncertainties, leading people to focus on necessary purchases.

On the other hand, there have been drops in spending on furniture and building materials, which could be attributed to consumers cutting back on non-essential or big-ticket items in response to the challenging economic environment. Interestingly, the data also shows higher spending on new/used cars, despite the overall consumer squeeze. This could be due to factors such as attractive financing offers or pent-up demand for automobiles.

Moreover, electronics and clothing sectors have held up relatively well, at least before adjusting for inflation. This resilience could be driven by factors like ongoing technological advancements and consumers’ desire to maintain a sense of normalcy and personal style despite economic challenges.

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account