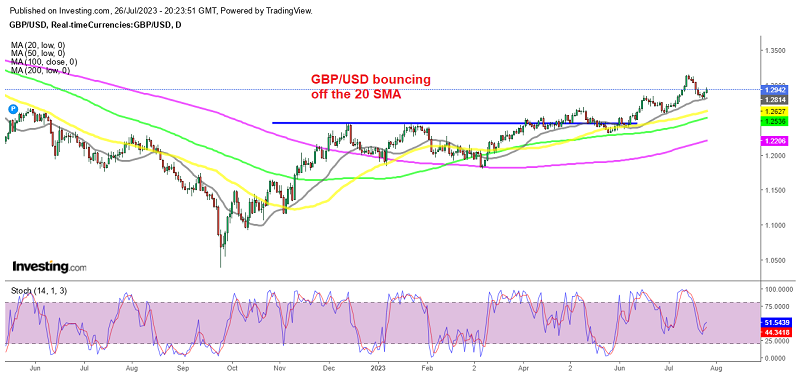

GBP/USD Still Remains Supported on the Daily Chart

GBP/USD found support at the 20 daily SMA once again this week after the retreat last week and the upside resumed again, helped by the FED

GBP/USD has been bullish since late September last year and it continues to make gains, with the upside giving momentum again in the last two months, after slowing down earlier this year. Moving averages have been acting as support, and in recent months the 20 SMA (gray) has taken over this position, which shows that the buying momentum is quite strong in this pair on the daily chart.

This moving average held the retreat in June and we saw a strong bounce in this pair, which pushed the price above 1.3150 as the USD went through another bearish period, following the weaker CPI and PPI consumer and producer inflation reports for June which came in quite soft. Although, last week GBP/USD retreated lower and the price fell below 1.30, reaching 1.28 where sellers met the 20 SMA which held as support again.

So, the is showing signs of a recovery earlier this week, after experiencing declines for seven consecutive against the US dollar. The US Dollar Index (DXY) is trading slightly lower today, which might be contributing to the pound’s attempt at a revival.

The movement in the pound today and throughout the week is not primarily influenced by UK-specific factors but rather by the dominance of high-impact economic data releases from the United States. This week, the US is set to release multiple important economic indicators, including the Federal Open Market Committee (FOMC) interest rate announcement.

Today’s focus will be on the advance GDP report for Q2 which is expected to show a 1.8% expansion of the US economy when it gets released later, following a 2.0% growth in Q1. If the actual figures align with or surpass the estimates, it would mark the highest level since January 2022. In such a scenario, the British pound, also known as “cable” in the financial markets, could be exposed to downside risks, considering that the FED left the September rate hike at the mercy of the data. If the GDP report misses expectations, then the upside momentum will continue.

GBP/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account