Forex Signals Brief July 28: Dovish ECB Hike, Higher US GDP

Yesterday the ECB turned softer after the 25 bps hike, the US GDP beat expectations while there were rumours about a BOJ policy change

Yesterday’s Market Wrap

After Wednesday’s FOMC meeting where the FED delivered on the promised hike, which took interest rates to 5.50%, markets calmed down pretty quickly as traders were already anticipating that. Powell stressed that they will be going meeting-by-meeting, which was a message we had heard before, but that also stressed the idea of keeping a September rate hike possibility alive. Although after the positive GDP reading which came at 2.4% for Q2 against 1.8% expected and the lower unemployment claims, that idea was reinforced yesterday. While the odds of another hike have only risen to 22% from 20%, there’s a plausible scenario where the US economy heats up., while higher Oil prices might bring back inflation worries.

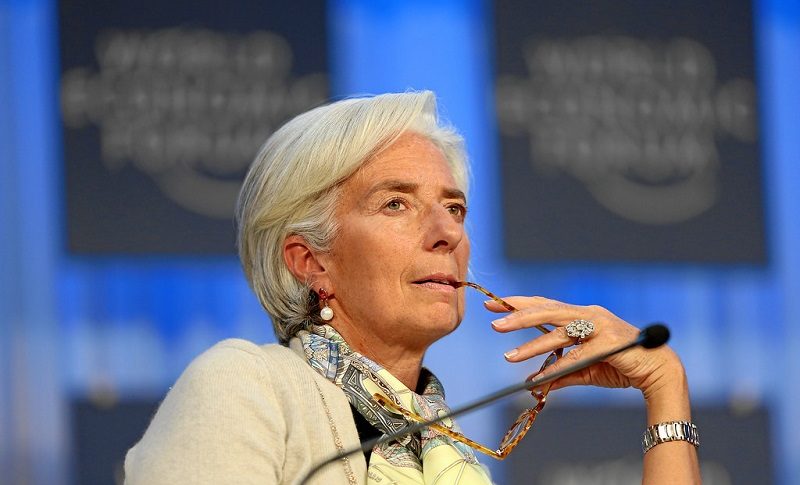

The European Central Bank meeting was expected to be similar to Wednesday’s FED meeting and that’s how it went. The ECB did raise interest rates by 0.25%, bringing the Main Refinancing Rate to 4.25% while the Deposit Rate increased to 3.75%. Although this was a dovish hike, as the ECB hinted that they could perhaps be done with rate hikes, which was later reinforced by president Lagarde who said that the slight change of a verb was not random or irrelevant, which left the Euro on a bearish footing, although EUR/USD had already started crashing down on stronger US data.

We also had news from the Bank of Japan, after a Nikkei report which said that the BOJ “will discuss” changes including dropping the 10-year cap in favor of a pledge to combat yield spikes. That sent the Yen surging higher, with USD/JPY falling around 250 pips lower despite broad USD strength. Risk assets also took a dive which, although crude Oil remained bullish despite a retreat on economic optimism and Saudi Arabia’s plan to extend the production cut.

Today’s Market Expectations

Today the attention has been on the Bank of Japan during the Asian session. Not much was expected from them, but a report from Nikkei yesterday suggested that they could tweak the yield curve which sent the Japanese Yen surging higher. The German Prelim CPI consumer inflation for July is expected to remain steady at 0.3% while the Spanish Flash CPI is expected to slow to 1.7% YoY from 19% last month. The Canadian GDP for May is expected to show a 0.3% expansion in May after falling flat in April. The Core PCE Price Index and the Employment Cost Index from the US will also be important for the fate of the USD today and both are expected to tick lower.

Forex Signals Update

Yesterday we had three main events, which increased the volatility and sent markets crashing down, apart from crude Oil. The Bank of Japan rumours about the wield control, the dovish ECB hike and the higher US GDP sent the Euro lower, while the USD and the JPY surged higher. We opened 7 trading signals, 4 of which hit the take profit target, and three closed in loss, although two of the winning signals were long term trades.

For more detailed updates, please refer to the section below.

GOLD Stalling at the 200 SMA After Losing $40

Gold has been bullish during most of July, although buyers failed to get close to the $2,000 level and yesterday we saw a strong bearish reversal, which sent the price almost $40 lower. Moving averages were keeping the trend bullish, providing support during retreats lower, but yesterday’s crash broke all technical analysis. The price did stall at the 200 SMA, but if the US data today comes in positive then this moving average won’t hold for too long.

XAU/USD – 240 minute chart

Considering the current market conditions, we are providing a trading signal as follows:

- Gold Sell Signal

- Entry Price: $1,955-60

- Stop Loss: $1,970

- Take Profit: $1,935

MA’s Turning Into Resistance for EUR/USD

Yesterday, the EUR/USD forex pair experienced a significant drop of almost 200 pips due to negative risk sentiment and a bullish turn in the USD. The European Central Bank (ECB) had previously maintained a hawkish bias, but as economic indicators pointed towards a potential contraction in the Eurozone economy, the market anticipated the ECB would soften its stance. This anticipation was confirmed when ECB president Christine Lagarde revised the statement to adopt a less hawkish approach.

As a consequence, the EUR/USD pair fell below the 1.10 level, indicating a bearish sentiment. Given the prevailing market conditions, it is expected that the price of EUR/USD will continue to decline further. Traders may look for opportunities to sell on retracements higher to capitalize on the bearish trend.

EUR/USD – H4 chart

Cryptocurrency Update

BITCOIN Continues Consolidation Above $29,000

Bitcoin was trading in a range above the $30,000 level, coming from a significant rise after reversing higher from $25,000. The range-boound price action continued for more than a month, with the $30,000 zone providing solid support. But, this week, the selling pressure returned and BTC broke below the support zone, falling to $29,000, where it has formed a new support zone, which seems to be holding for now. The 50-period Simple Moving Average (Yelloy) is acting as support and the price continues to hang around above that moving average.

BTC/USD – Daily chart

We decided to open another buy Bitcoin signal on Monday, playing the range again, buying BTC/USD just above $30,000:

- Entry Price: $28,000 or $28,500

- Stop Loss: $26.500

- Take Profit: $31,300

ETHEREUM Slightly Crawling Higher

Ethereum made a strong bounce and moved above $2,000 earlier this month as buyers remained in charge. We have had quite a few long term buy Ethereum signals since the trend has been bearish since the beginning of 2023, with the lows getting lower. Although since then the pressure has been to the downside, but Ethereum has still shown more resilience than Bitcoin. So, we decided to open a buy ETH signal on Monday after the retreat, so we’re betting on moving averages to act as support and hold the retreat and the 100 SMA (green) seems to be holding.

ETH/USD – Daily chart

- Entry Price: $1,860

- Stop Loss: $1,740

- Take Profit: $2,020

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account