GBP/USD Survives the First Test As BOE Leaves Door Open After Hike

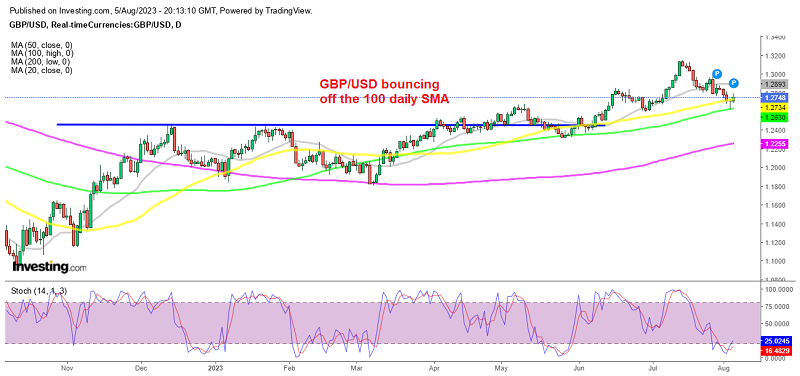

GBP/USD has been on a bullish trend since September when the Bank of England intervened and ended the drama in UK Gilt yields. This pair climbed around 18 cents from the bottom after it climbed above 1.30 by the middle of July, but reversed lower three weeks ago and since then it has been making lower highs. Although, the main trend is still bullish as seen on the daily chart below, and moving averages are still acting as support in this timeframe, particularly the 100 SMA (green) which held during the retreat in May.

This time the price touched this moving average on Thursday after the Bank of England meeting and bounced right back up, helped by some USD weakness due to the softer NFP jobs numbers on Friday. GBP/USD bounced more than 150 pips higher, but buyers failed to push above 1.28 and eventually, the price retreated to close the week just below 1.2750.

The bounce didn’t seem convincing, although this could be the beginning of the reversal as the larger bullish trend resumes, or will the decline continue? Both currencies are under scrutiny as both the FED and the BOE are still leaving a possibility for more hikes despite slowing inflation, which can send this pair in either direction. So, we will be following the price action early next week, to see which way the sentiment will shift, so we can go with the flow.

The Bank of England raised interest rates by 25 basis points in accordance with market expectations on Thursday, and there is a possibility of further rate increases in the coming months, with markets pricing in a terminal top at 5.75% by next March. The central bank is keeping a close watch on economic data and is also considering adjustments to the rate of UK bond sales to help manage monetary conditions.

Main Comments from Bank of England by Topic

Inflation and Prices:

- Bailey expects inflation to drop to about 7% in July and to around 5% by October.

- A more gradual decrease in energy prices compared to the Euro Zone contributes to this trend.

- Food and drink inflation seems to have peaked, with an expectation for food price inflation to gradually fall this year. However, the decline of food price inflation has been slower than anticipated, partly attributed to global factors like less impactful Russian restrictions on grain exports.

- For non-energy prices, it’s less clear how quickly they will reduce.

- Despite volatile elements, a persistent strength in service price inflation could suggest a continuation of high inflation.

Monetary Policy:

- Bailey acknowledges the clear impact of the higher bank rate, affirming that there’s more than one path for rates that could bring inflation back on target.

- The BOE will assess the most suitable path for rates based on evidence.

- There’s a need to balance risks, as some risk relative to May has materialized.

- A 50 basis point rate increase was not deemed necessary at this time. The central bank is not at its peak on rates and remains evidence-driven, with no set path for interest rates from here.

- It’s too soon to speculate on when the BOE might cut rates.

Labour Market and Wages:

- The condition of the labour market and pay rates have a significant impact on the economy.

- Recent pay growth is considerably above the Bank’s May forecast, suggesting that secondary effects of wage inflation might take longer to fade.

- Despite other elements of the labor market softening, the pay element has not.

Economic Growth and Resilience:

- Projections for economic activity have weakened since May, with some unpleasant surprises in June but also some recovery.

- Unemployment remains historically very low, demonstrating the resilience of the economy.

- Despite the challenges, Bailey avoids describing the impact of the policy as “painful” and hopes to achieve the expected path without a recession.

Housing Market:

- Bailey doesn’t perceive the situation as a crisis for the housing market.

BOE Deputy Gov. Ramsden on QT said:

- The Bank of England has not made a decision on the pace of Quantitative Tightening (QT) for September.

- Ramsden personally sees a case for slightly increasing the pace of QT.

- He notes that bond markets are reacting to developments, including those in the US.

- Ramsden doesn’t believe there’s a structural change occurring in the bond market.