Commodity Dollars Remain Soft After Falling China Inflation Numbers

We remain short on all commodity dollars as softer data from China is keeping risk sentiment subdued

The Asian markets experienced a general decline yesterday and were soft today as well, as investors turned their attention to China’s upcoming inflation figures and trade balance data, scheduled to be released today. In terms of market performance, Hong Kong’s Hang Seng index saw a slight increase, while the mainland Chinese markets all ended in negative territory. The Shanghai Composite index fell by 0.59%, concluding at 3,268.83 points. Likewise, the Shenzhen Component index declined by 0.83%, closing at 11,145.03 points.

Japan’s Nikkei 225 index managed to rise by 0.19%, reaching a closing value of 32,254.56 points. This rebound allowed it to recover from earlier losses during the day. Additionally, the Topix index also experienced a positive movement, increasing by 0.41% and finishing at 2,283.93 points. Regarding Japan’s central bank, the Bank of Japan (BOJ), in its summary of opinions from its meeting held on July 28, indicated that it still believes there is a “significantly long way to go” before considering any revisions to its stance on its negative interest rate policy.

The sentiment in the region was further subdued by Chinese trade data yesterday that came in weaker than anticipated. Both Chinese imports and exports experienced a significant decline, marking their sharpest drop since the outbreak of the COVID-19 pandemic in 2020.

This week, inflation data from both the United States and China is expected to provide additional insights into the economies of these two global giants. However, these readings are anticipated to move in opposite directions. Analysts are predicting a minor uptick in consumer inflation in the U.S. for the month of July. In contrast, Chinese inflation were projected to remain close to contractionary levels.

China CPI and PPI Inflation Reports

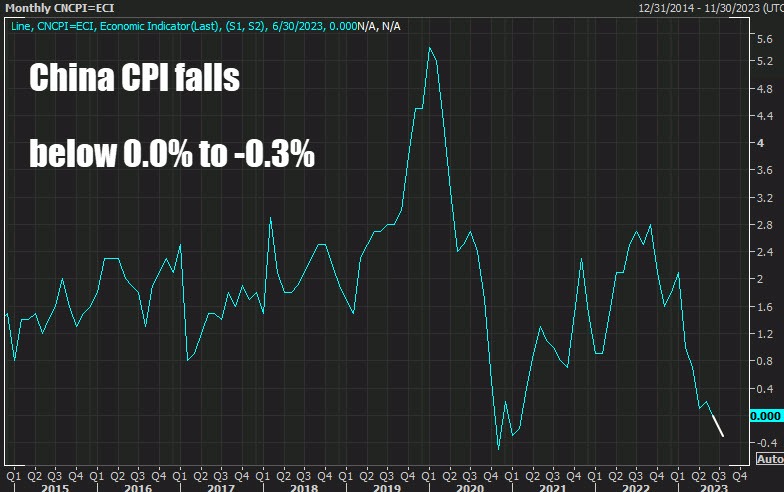

- CPI MoM +0.2% vs -0.1% expected. YoY -0.3% vs -0.4% last expected

- Prior month CPI YoY 0.0%

- Prior month CPI MoM -0.2%

- China CPI MoM for July 0.2% vs -0.1% expected

- China CPI YoY for July -0.3% vs -0.4% expected

- China PPI YoY for July -4.4% vs -4.1% expected. Prior month -5.4%

The YoY falling below 0.0% is the first since February 2021. There is little reaction to the mixed inflation data.

The fall below 0.0% in CPI and PPI is the first since 2020, but China NBS says the decline in CPI is only temporary.

AUD/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account