NZD/USD Slips Lower As Markets Await Tomorrow’s Data

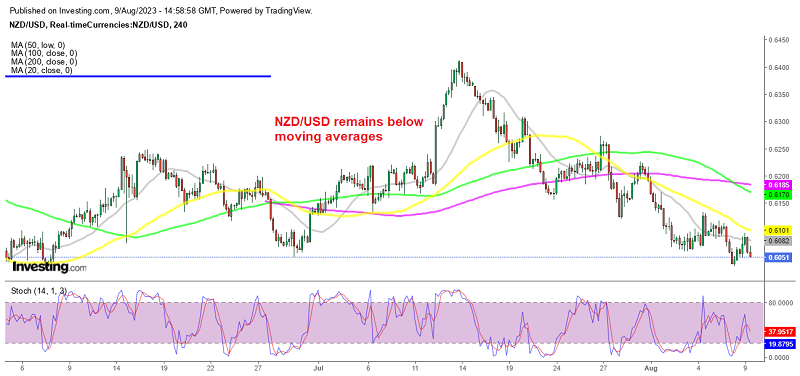

The commodity dollars are showing increasing weakness during the US session so we continue to remain short on NZD/USD

Today the trading was pretty quiet, with no significant economic data releases send the markets around. Market flows were light, and major currencies didn’t show strong movement. The USD started off weaker after the retreat yesterday in the us session, but has since stabilized and is trading with mixed results. Traders are turning their attention to the upcoming US Consumer Price Index (CPI) report, which could influence market direction.

The EUR/USD pair maintained the bullish momentum and approached 1.10, while USD/JPY stayed above 143.00, surging to 143.70 a while ago. The foreign exchange market lacked significant movements during the European session as equities and bonds also didn’t experience much excitement, although we saw a slight pick-up in activity.

European stocks were higher in the morning, following a late buying trend in Wall Street during the previous day. On the other hand, US futures showed slight gains, indicating a brief pause after the selling pressure observed since the beginning of August. Although all stock markets are slightly lower n the day, indicating that risk sentiment has been turning negative during the US session. One notable standout today is the Oil market. WTI crude oil prices surged to nearly $84.65 per barrel, marking a 1.5% increase and reaching the highest levels for the year.

Commodity dollars were bullish during the Asian session, with the Aussie making the most of it. Although they started turning lower as the sentiment soured and are heading back down now. We booked profit on our long USD/CAD signal and are short on NZD/USD , which we’re holding as this pair continues to show weakness.

NZD/USD Live Chart

NZD/USD

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account