USD/JPY Dives on Markets Pricing the End of the FED Rate Hike Cycle

USD/JPY has been making really strong gains but yesterday we saw a 170 pip reversal after the decline in JOLTS jobs and softer CB consumer

Throughout this month, the US dollar (USD) has exhibited a notably bullish trend. This is attributed to the Federal Reserve (FED) adopting a hawkish stance in its communication. The FED has reintroduced the concept of making rate hike decisions based on data dependency. As a result of this rhetoric, the USD/JPY currency pair has achieved significant and robust gains.

Yesterday, there was a noteworthy breakout in the USD/JPY pair, and this breakout has been reflective of a broader strengthening of the US dollar. Initially, during the Asian and early European trading sessions, there was a decline in Treasury yields. However, these yields have since rebounded and are now on the rise. Specifically, the 10-year Treasury yields have moved up to 4.22% from a previous low of 4.17%.

In July, job openings in the US experienced a notable and rapid decline. This is a significant indicator that the Federal Reserve (Fed) closely monitors. Concurrently, there was an unexpected decrease in US consumer confidence, although this occurred from previously elevated levels.

The financial market is becoming attuned to potential challenges on the horizon for the US. This development is likely to provide further rationale for Federal Reserve Chair Jerome Powell to exercise caution regarding rate hikes in the upcoming September meeting. It is anticipated that Powell will maintain a stance of signaling a preference for rate hikes, yet as the November meeting approaches, it is expected that the situation will become clearer in terms of a noticeable slowdown in economic growth.

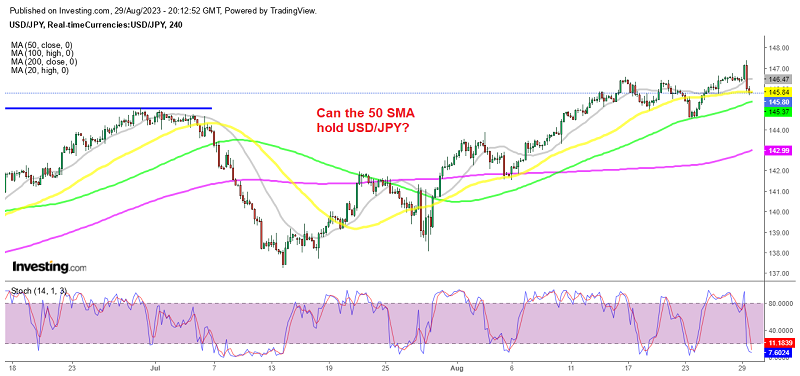

USD/JPY made a sharp reversal after a decent rally of around 80 pips earlier in the day, which sent the price to 145.70s. Although that’s where the 50 SMA stood on the H4 chart, which has held twice as support earlier, since the bullish trend resumed in July. So, we are following the price action to see whether this moving average will hold as support.

USD/JPY Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account