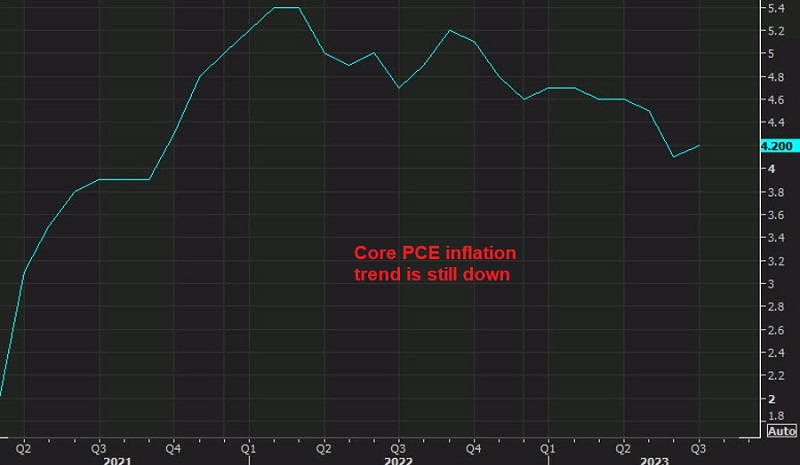

Markets Uncertain As PCE Inflation Moves Higher in July

The US PCE inflation showed a pick up in July, which is keeping traders confused about the FED policy, helping the USD today

Today is the final day of the month and it’s a busy one on the economic calendar with a wave of numbers coming out from China, Europe, and later North America. The economic data from the US has been showing increasing weakness in the economy which has been the reason for the recent retreat in the USD. Inflation has been cooling as well, as the PCI data has been showing.

However, the PCE report is the FED’s preferred inflation measure and the core reading was expected to tick up to 4.2% in July from 4.1% in June. Claims were expected to come at 235K ahead of tomorrow’s non-farm payrolls (NFP) report, although they came slightly lower at 228K. The Core PCE did tick higher to 4.2%, while the headline PCE inflation increased by 3 points to 3.3% from 3.0% previously. So, the inflationary pressures are not over yet, as prices keep increasing faster than earnings, despite coming down from record levels we saw last year.

The market had mixed reactions to these numbers, as the economy is clearly showing signs of slowing down but the PCE inflation is holding up, which might keep the FED still undecided. So, the uncertainty remains with EUR/USD losing around 100 pis from yesterday’s higher, while USD/JPY is making a reversal after the fall earlier this week. It has already climbed 60 pips higher from today’s lows. GOLD has been quite strong in the last two weeks, but it has found resistance just below the $1,950 zone and slipped to $1,940 just now.

US July 2023 Core PCE Personal Consumption Expenditure Report

- July core PCE inflation YoY +4.2% vs +4.2% expected

- June core PCE YoY was +4.1%

- PCE core MoM +0.2% vs +0.2% expected

- Prior PCE core MoM was +0.2%

- Headline inflation PCE YoY +3.3% +3.3% expected

- Prior headline PCE YoY was +3.0%

- Deflator MoM +0.2% vs +0.2% expected

- Prior deflator MoM was +0.2%

Consumer spending and income for July:

- Personal income +0.2% vs +0.3% expected. Prior month +0.3%

- Personal spending +0.8% vs +0.7% expected. Prior month +0.5%

- Real personal spending +0.6% vs 0.4% prior

The numbers we’re seeing are quite stable overall. Inflation has remained steady, matching the cooling wage growth, and people are still spending confidently. These figures suggest that we might be experiencing a controlled economic slowdown, or possibly even a period of steady growth without any sudden drops. However, it’s important to note that this is typically how a slowdown begins – gradually.

Following the release of this data, there’s been a bit of increased interest in buying bonds, which could indicate that people are becoming less worried about the impact of inflation. The headline indicator for economic performance has risen slightly, and it’s expected to increase again in August due to higher energy prices.

Gold Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account