Booking Profit On the Crude Oil Signal After Saudis Announce Production Cuts

Crude Oil has just surged $2 higher after the announcement of output cuts from Saudi Arabia and we caught that move with a buy Oil signal

The global economy has been showing increasing weakness in recent months, with different sectors falling into contraction. The US economy was holding up well, but it is also showing difficulties, with the employment sector slowing, while the troubles in China are adding further to the decline in risk assets.

However, crude Oil has been bullish despite all this, with Saudi Arabia trying everything to keep prices up. In fact, OPEC+ is preparing for further production cuts. Russian Deputy Prime Minister Alexander Novak commented last week, saying that the OPEC+ members had agreed to implement new production cuts and it wasn’t unexpected for the markets.

This announcement followed Saudi Arabia’s earlier statement, in which they extended their existing output cut measures through September. Furthermore, Saudi Arabia indicated that these committed production reductions could potentially be prolonged or escalated beyond September.

This ongoing cooperation between OPEC+ members continues to influence global Oil markets and is closely monitored by industry stakeholders and analysts. US WTI crude peeked above $86 yesterday as the USD was retreating during the European session.

Although, we have seen a retreat in the last few sessions, which was attributed to the latest data revealing that the pace of growth in China’s services slowed during August, falling short of market expectations. The Caixin General Services Purchasing Managers’ Index (PMI) for China was reported at 51.8 points in August, down from 54.1 points in July. Market analysts had anticipated a higher reading of 53.6 points for August. This data from Caixin Insights indicated that August marked the weakest performance in the services sector over the past eight months.

Caixin Insights also noted that new export business from China experienced a decline for the first time since December. However, the services sector’s performance was supported by local demand in China, allowing the services PMI to remain above the 50-point threshold for August. This data from China’s services sector has implications for global oil markets, as it reflects the health of one of the world’s largest energy consumers and can influence oil demand and pricing dynamics.

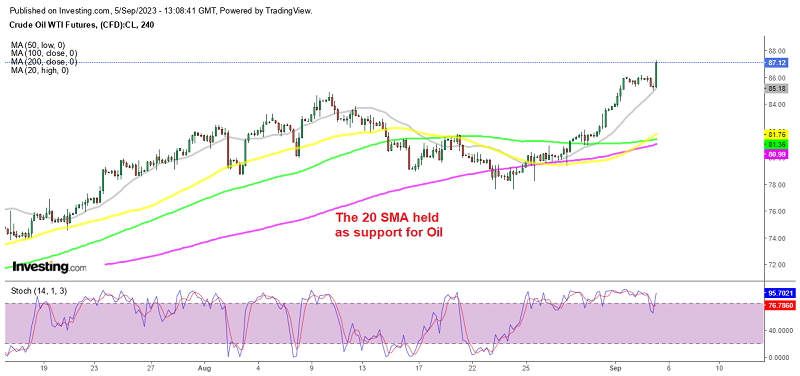

Besides that, Caixin manufacturing showed last week that this sector came out of contraction after just a month. So, we decided to open a buy Oil signal just above the 20 SMA (gray) which acted as support on the H4 chart. A doji candlestick formed which is a bullish reversing signal after the retreat and we went long on WTI. That forex signal just closed in profit after Saudi Arabia announced the cuts through year-end. Their production for Oct, Nov and Dec will be 9 million barrels/day, with Russia expected to offer the same. Crude Oil is jumping, rising by almost $2 now after earlier falling by 50 cents.

US WTI Crude Oil

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account