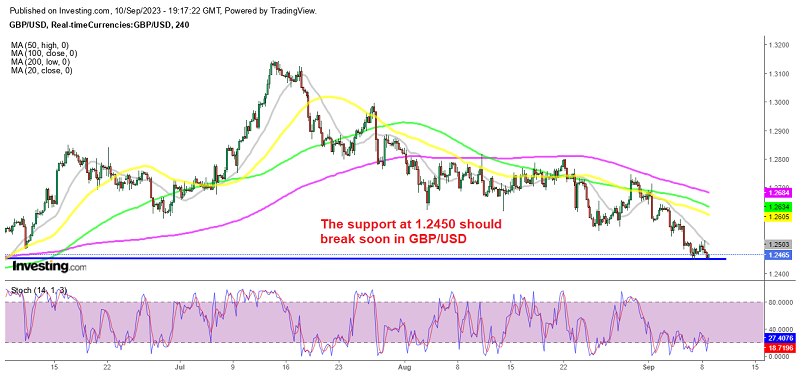

GBP/USD to Break Below Major Support/Resistance Level at 1.2450

The economic data has been weighing on the GBP and this week's employment and GDP figures won't likely change the trend

GBP/USD has been bearish since the middle of July, when it reversed at 1.3150 making lower highs and declining constantly. This air has lost around 7 cents from the top and it closed last week at 1.2450, which has been acting as a strong resistance before. We saw a bounce late last week as this support zone held in the first attempt, but the 20 SMA (gray) turned into resistance on the H4 chart and the price returned to this level pretty quickly. This shows that sellers are in control and they will likely break this level soon.

This forex pair experienced a significant bearish breakout on the daily chart last week. It managed to breach a key support level located just below 1.26, and this breakout led to a further decline, bringing it down to the 1.2450 level. The breach of the 1.2450 support level would open up the possibility of declining even further, potentially targeting the 1.2310 level this week. However, it’s worth noting that after such a substantial move, it’s not uncommon to witness a pullback in the price action.

Although, the economic outlook from the UK doesn’t look promising for the GBP either. The latest employment report indicated an increase in the unemployment rate. The rise in unemployment alongside wage growth can be indicative of stagflation, a situation characterized by stagnant economic growth and high inflation as the last UK CPI inflation report exceeded expectations, indicating that consumer prices are rising faster than anticipated.

The UK’s manufacturing and services PMI data recently missed expectations across the board. Notably, the Services sector which is a substantial part of the UK economy registered a significant decline, entering a state of contraction. The market currently anticipates that the Bank of England will raise interest rates by 25 basis points (bps) at its upcoming meeting, although that’s not helping the GBP.

This week we have the employment report from Britain, with the unemployment rate expected to tick higher from 4.2% to 4.3%. However, the focus is more on wages numbers, with Average Earnings ex-Bonus at 7.8% and Average Earnings incl. Bonus at 8.2%. A rate hike in September is almost certain, so this report’s impact will be minimal for the GBP. So, we will try to sell retraees higher in GBP/USD in case of a positive reading.

GBP/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account