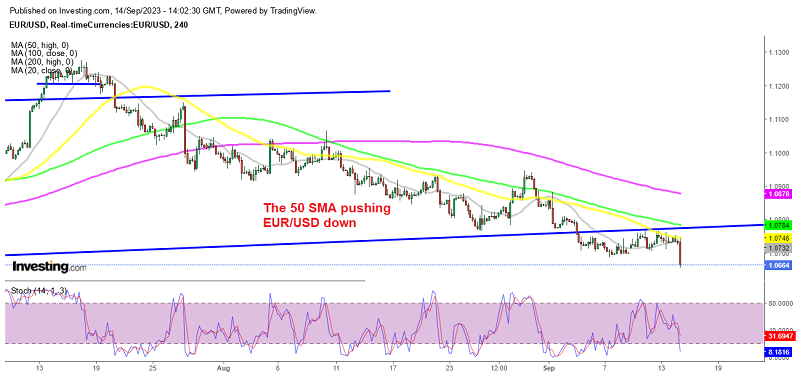

Euro Dives on ECB Ending the Hiking Cycle

EUR/USD falls below 1.07 as ECB statement suggests that they are done with raising interest rates any further

The ECB started hiking interest rates later than most other major central banks and markets were expecting it to keep the tightening path longer than them, which was keeping the Euro bullish from October last year until July this year. But recently we have seen dovish signals from them as the Eurozone economy continues to show strong signs of a recession. The Euro has turned bearish as markets now anticipate the ECB to remain on hold before reversing the policy to accommodative.

In the wake of the ECB decision, the EUR/USD fell from 1.0730 to 1.0695, despite the central bank’s 25 basis point rate rise today. The main point is that they signaled that this should be the last rate rise of the cycle, and the story is supported by weaker economic and inflation expectations for the next year.

There were other ways the ECB could have handled it today, but in my opinion, this is the worst one for the Euro. The EUR/USD pair has moved below this month’s lows, reaching 1.0656, as US data also caused this pair to decline as the USD increased due to some positive economic data. Now, this pair is aiming for the May low of 1.0635.

ECB Monetary Policy Decision – 14 September 2023

- Main refinancing rate 4.50% vs 4.25% expected

- Prior refinancing rate was 4.25%

- Deposit facility rate 4.00% vs 3.75% expected

- Prior deposit rate was 3.75%

- Marginal lending facility 4.75%

- Prior marginal lending facility was 4.50%

- Inflation continues to decline but is still expected to remain too high for too long

- Past rate hikes continue to be transmitted forcefully

- Financing conditions have tightened further and are increasingly dampening demand

- ECB considers that key rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target

- Future decisions will ensure that the key rates will be set at sufficiently restrictive levels for as long as necessary

- ECB will continue to follow a data-dependent approach to determining the appropriate level and duration of restriction

- Full statement

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account