USD Jumps After Another Impressive Round of Economic Data

The USD has resumed the bullish trend again as the economic data remains upbeat, showing no signs of an upcoming recession

Today markets were pretty quiet during the European session, with major currencies not moving much as traders awaited the ECB decision and a round of important economic data from the US which was released a while ago. Overall, there wasn’t much confidence, with the dollar being more muddled and little movement being seen. However, that changed with the publication of US data, including retail sales, producer inflation measured by the PPI, and unemployment claims, all of which exceeded forecasts.

The USD has been on a bullish trend for around 2 months, as FED’s remarks have hinted at keeping the rate hikes coming as long as the data shows decent economic health. The data has been upbeat, or at least not showing an upcoming recession, which has been keeping the USD up and risk assets down. We saw some soft economic figures early this month and the USD retreated lower, but in the last two weeks, the data has shown improvement, which has raised the odds of another November rate hike by the FED. Retail sales have been positive since April and in the last two months, they have beat expectations, which has been keeping the USD supported.

We have been long on the USD and will continue to do so, booking profit on sell EUR/USD , GBP/USD , and GOLD signals today. EUR/USD tumbled below 1.07 while Gold headed for $1,900 before retracing hgiher again, so we decided to sell XAU/USD again. USD/JPY dived lower for a while but is back up now. The retail sales report is listed below and the details are pretty upbeat as well:

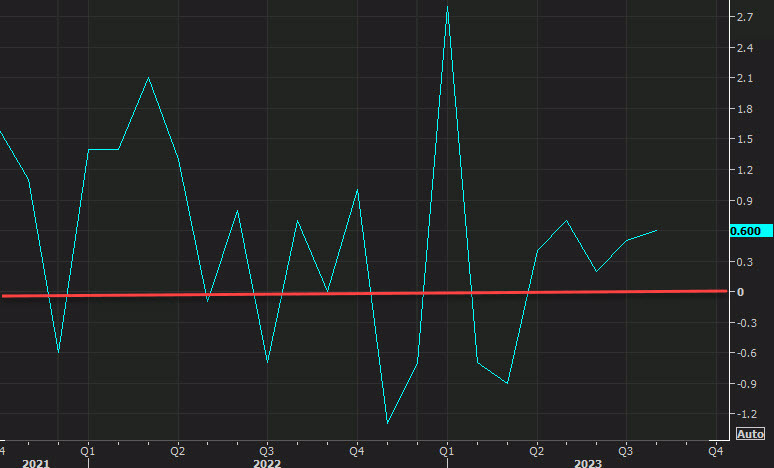

US August 2023 Retail Sales Report

- Retail sales MoM +0.6% versus +0.2% expected

- Prior retail sales were +0.7% (revised to +0.5%)

Details:

- Core sales ex-autos +0.6% versus +0.4% expected.

- Prior core sales ex-autos were +1.0%

- Control group +0.1% versus -0.1% expected

- Prior control group +1.0% (revised to +0.7%)

- Retail sales ex gas and autos +0.2%. Prior month +1.0% (revised to +0.7%)

- Retail sales total $697.6 billion vs $696.4 billion prior

The report looks great, apart from the revisions in July’s headline. Electronics and apparel both had good monthly growth of 0.9% and 0.7%, respectively. These are economically delicate categories that indicate a tough customer.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account