EUR/GBP Retreats on Dovish ECB Comments About Eurozone Economy

EUR/GBP has reversed from above 0.87 as the Euro resumes decline on softer economic indicators and dovish ECB comments

EUR/GBP has been bullish for most of this month, reversing from around 0.8520s and extending for the 0.8704 mark on Friday, ending the week with more than a full percent of upside gains, with the Euro (EUR) having its best trading week versus the Pound Sterling (GBP) since early February.

The GBP plummeted after the Bank of England surprisingly held interest rates steady, with GBP/USD falling below 1.22 a while ago today. The outlook has shifted substantially in recent weeks, and investors are apprehensive about future growth prospects of the UK economy. BOE governor Bailey stated that if economic growth continues to worsen, they will likely not need to deliver any more raises. Inflation is still high despite cooling off recently, and has a long way to go down before policymakers can contemplate reducing rates.

But the Eurozone economy is doing equally or even worse than the UK economy, turning the ECB dovish as well, and today’s comments from ECB members confirmed that, sending EUR/USD below 1.06. ECB’s Schnabel said earlier that the activity in the Eurozone is clearly moderating while Lagarde popped up later also with dovish remarks.

Comments from ECB President Christine Lagarde

- Recent indicators point to further weakness in the third quarter

- Job creation in the services sector is moderating and overall momentum is slowing

- Inflation continues to decline but is still expected to remain too high for too long

- We aim to conclude review of ECB framework by spring 2024

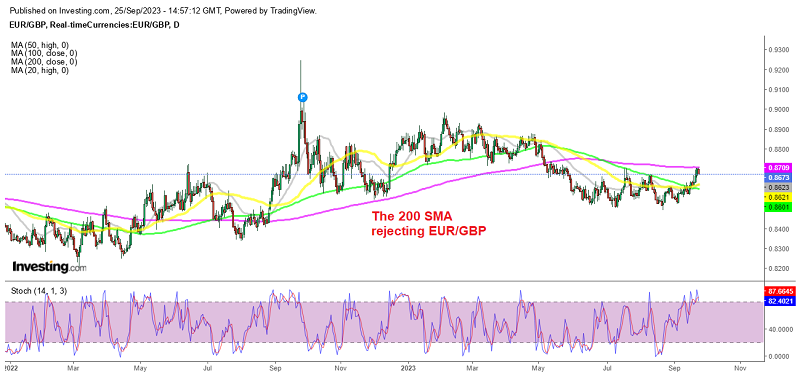

This is weighing further on the Euro and EUR/GBP has reversed above 0.87. The EUR/GBP daily chart indicates significant resistance from both the psychological zone around the 0.8700 level and the 200-day SMA (purple) which is already rejecting the price today. If the bullish momentum continues, upside targets include 0.8740 and 0.88. On the downside, 0.8625 serves as the first support zone and it seems like we might be headed this way after today’s reversal from the 200 SMA.

EUR/GBP Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account