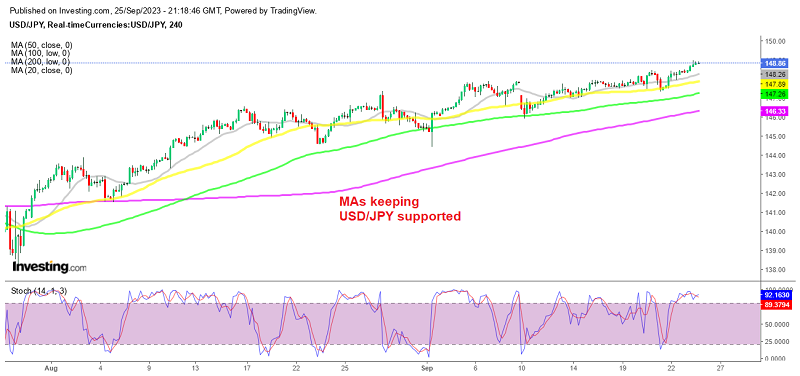

USD/JPY at 149 after No FX Intervention Comments by Japanese Officials

USD/JPY is looking at 150 after making massive gains in the last two months and the Bank of Japan is not intervening

USD/JPY has been quite bullish for months and it knocked on the 149 level yesterday. The hawkish FOMC meeting on Wednesday last week gave the USD further support, fuelling the uptrend on this pair further. This pair retreated lower to 147.30s as we neared the Bank of Japan meeting on Friday, but they failed to satisfy the market’s expectations after comments from Kazuo Ueda, governor of the Bank of Japan, who stated that the central bank may abandon its negative interest rate strategy.

In order to increase inflation and growth, the Bank of Japan has kept bond yields negative, while other major central banks have hiked rates to multi-year highs, resulting in the JPY being used as a lending currency against a range of other high-yielding currencies, including the USD. With US Treasury yields continuing the march higher, the USD remains in demand, supporting the bullish momentum in this pair.

Goldman Sachs continues to be positive on the USD/JPY, anticipating that the pair would reach 150 by the end of the year and 155 in the following six months. This prognosis is supported by the bank’s expectation of extended high interest rates by the FED, solid US economic growth, and a more dovish approach from the Bank of Japan. Yesterday we had a number of speeches from Japanese officials such as the BOJ governor Kazuo Ueda, the Japanese Prime Minister and the BOJ Dep Gov Uchida who said that they need to closely watch FX markets. But no mention of an intervention in the forex market, which left buying in charge in USD/JPY.

Bank of Japan Gov. Ueda Commentary From Yesterday

- Japan’s economy recovering moderately

- Our basic stance is that we must patiently maintain monetary easing

- Current policy framework has big stimulative effect on economy, but at times could cause big side-effects

- BOJ’s July move helped heighten sustainability of our monetary easing framework

- Our baseline scenario is for key driver of inflation to gradually switch, strengthen virtuous wage-inflation cycle

- Effect of rising import prices likely to gradually dissipate

- Uncertainty surrounding our baseline scenario is very high, not sure at this stage whether this will materialize

- There is good chance wage growth will accelerate as competition for talent intensify

- Changes in corporate behaviour could speed up more than expected

- On the other hand, wages, prices may struggle to rise if Japan’s economy is hit by negative external or internal shocks

- Many firms still have not decided whether to hike wages significantly, so we must scrutinise whether changes in corporate wage-setting behaviour could be sustained

- Stable, sustainable achievement of 2% inflation not yet in sight

- Japan’s economy is at critical stage on whether it can achieve a positive wage-inflation cycle

- Must continue to be vigilant to chance past sharp US rate hikes could affect economy, financial system with a lag

- Chinese economy’s slow pace of pick-up is also worrying

- It is true inflation is exceeding 2% for prolonged period, but that alone cannot lead us to conclude that Japan is close to stably, sustainably achieving our target

- Key to whether Japan is close to achieving our target is whether wage growth leads to moderate rise in inflation

- Japan firms are changing prices more frequently than in past, which is important sign suggesting wages and inflation could move in tandem

There is plenty of nuance in Ueda’s remarks. The summary is that bolded comment though. Without stable and sustainable 2% inflation there is little urgency for the Bank of Japan to tighten monetary policy.

USD/JPY Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account