Gold’s Decline Paused by US Dollar Retreat: A Comprehensive Overview

Over the course of this week, the price of Gold (XAU/USD) has witnessed a consistent dip, reaching a nadir not seen since March 10th,

Over the course of this week, the price of GOLD (XAU/USD) has witnessed a consistent dip, reaching a nadir not seen since March 10th, hovering around the $1,858-1,857 bracket on Thursday. While a significant retraction in the US Dollar (USD) from a decade-high offers a cushion to the fall, GOLD found it challenging to entice significant buying interest in Friday’s Asian trading window. Concurrently, the imminent risk of a US government shutdown on October 1, coupled with growing concerns about China’s faltering real estate market, offers a mild bolster to the allure of the traditionally safe asset.

Despite these factors, a sustained rebound for GOLD remains uncertain, especially given the prevalent sentiment that the Federal Reserve will maintain its assertive monetary posture. Reinforcing this, recent communications from the US central authority flagged enduring inflationary pressures, hinting at another potential interest rate augmentation before year-end. Given the robust economic footing of the US, prolonged higher rates appear plausible, subsequently amplifying US bond yields and reinforcing the USD. This scenario, naturally, paints a challenging backdrop for the non-interest-bearing commodity, indicating a potential further descent.

As investors exercise prudence, many may opt to hold off until the unveiling of the US Core PCE Price Index—a pivotal inflationary barometer for the Federal Reserve. Its implications will undoubtedly shape USD valuation, thus providing directional clarity to Gold’s trajectory. Concurrently, anticipated policy intensification from the Federal Reserve would likely fortify both US bond yields and the greenback, further suppressing any significant upward shifts for the USD-priced asset.

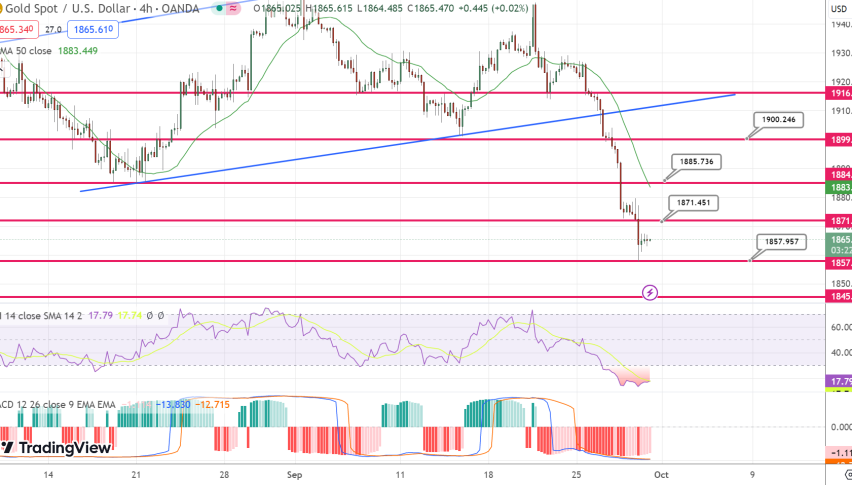

Technical Analysis on Gold

From an analytical vantage, the daily chart’s Relative Strength Index (RSI) signals potential overextension to the sell-side, suggesting traders bearish on Gold should proceed with circumspection. A judicious approach would involve awaiting short-term stabilization or a minor upturn before cementing further bearish stances. Nonetheless, any upward attempts might only serve to draw renewed selling pressure, likely capping gains near the recent peak of approximately $1,880. In contrast, the established low of the $1,858-1,857 range acts as a bulwark against deeper plunges, with breaches potentially fast-tracking a descent towards the support threshold of roughly $1,820.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account