USD/CAD Uncertain Between MAs As USD and CAD Remain the Strongest Currencies

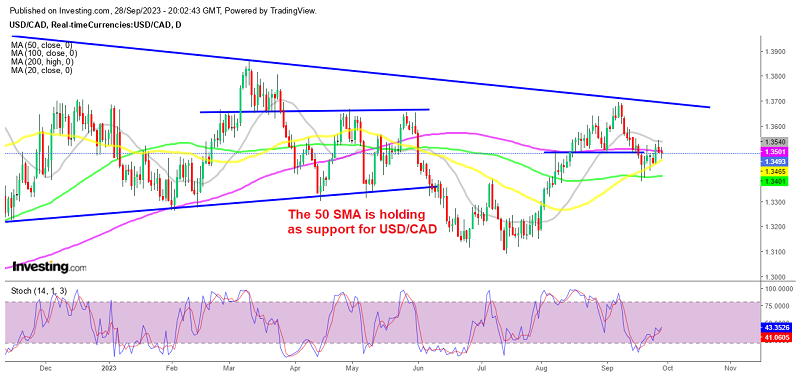

USD/CAD is bouncing between the 20 and 50 SMAs on the daily chart as the USD and the CAD both show resilience

USD/CAD began to rise in July, rising from roughly 1.31 to 1.37 until early September, as the USD profited from such an environment. However, in the previous two weeks, commodities dollars have advanced while the USD has declined. The move was more dramatic in the CAD, which benefitted from a rise in oil prices, with WTI reaching $93.

The situation in China seems to be improving after the economic woes earlier, with huge bankruptcies in the property market. Nomura has raised China’s GDP forecast for the year to 4.8%, which is helping risk sentiment and, thus commodity dollars. But, the Canadian dollar has had some strong support from surging Oil prices as well. The advance has been more pronounced for the CAD, as crude oil prices have risen over one-year highs, owing to persistent signs of tightening global supply and cautious optimism about an economic rebound in China, the world’s largest Oil importer. The WTI price was up yesterday, trading above $95 per barrel before retreating lower.

On the daily chart, we can see that USD/CAD returned below 1.35 level after a large fall after first the robust Canadian wage growth statistics and then the higher-than-expected inflation estimates. The pair rebounded off the crucial support and is currently consolidating around the prior support, which has now turned into resistance at the 1.35 handle. However, at the moment this pair remains stuck between the 50 daily SMA (yellow) at the bottom and the 20 SMA (gray) at the top after the Canadian GDP inflation report for July.

Canada July 2023 GDP Report

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account