Gold’s Downward Spiral Persists Amid Strengthened USD and Elevated US Treasury Yields

As Gold inches its way into another declining session since September 25, its trading value hovers close to $1,820 per troy ounce during Wednesday's initial Asian market hours.

As GOLD inches its way into another declining session since September 25, its trading value hovers close to $1,820 per troy ounce during Wednesday’s initial Asian market hours. A confluence of heightened risk aversion and a robust US Dollar (USD) places the yellow metal under considerable stress.

Despite the moderate economic figures from China over the past weekend, Gold’s trajectory remains unswayed. Specifically, China’s NBS Manufacturing PMI for August exhibited an uptick, registering at 50.2 from the earlier 49.7, surpassing the anticipated 50.0 benchmark. Concurrently, the Non-manufacturing PMI ascended to 51.7 from the preceding 51.0, outstripping the predicted 51.5. However, the Caixin Manufacturing PMI reflected a downturn for September, standing at 50.6 from its prior 51.0, contrary to the expected rise to 51.2.

The US Dollar Index (DXY) reached an elevational stride, marking an 11-month zenith in the previous trading day, fueled by solid US job statistics and an uptick in US Treasury yields. Presently, the index is estimated around the 107.10 mark.

The US’s impressive JOLTS Job Openings statistics further buttressed the upward trend in US Treasury yields. In particular, the 10-year US Bond yield peaked at its most elevated since 2007, tapping 4.81% this Tuesday.

According to the JOLTS report, job vacancies witnessed an upswing, settling at 9.61 million for August, a significant leap from 8.92 million and transcending market forecasts. Moreover, the US Federal Reserve’s (Fed) anticipated monetary policy trajectory fortifies the buoyant aura encircling the US Dollar. Cleveland Federal Reserve’s Loretta Mester hinted at a potential rate elevation in forthcoming meetings, contingent on the continuity of current economic scenarios. Conversely, Atlanta Fed’s Raphael Bostic conveyed a more restrained stance, emphasizing a deliberative approach to rate adjustments.

All eyes are now on the forthcoming US labor data, particularly with the ADP report’s imminent release on Wednesday, succeeded by Friday’s Nonfarm Payrolls.

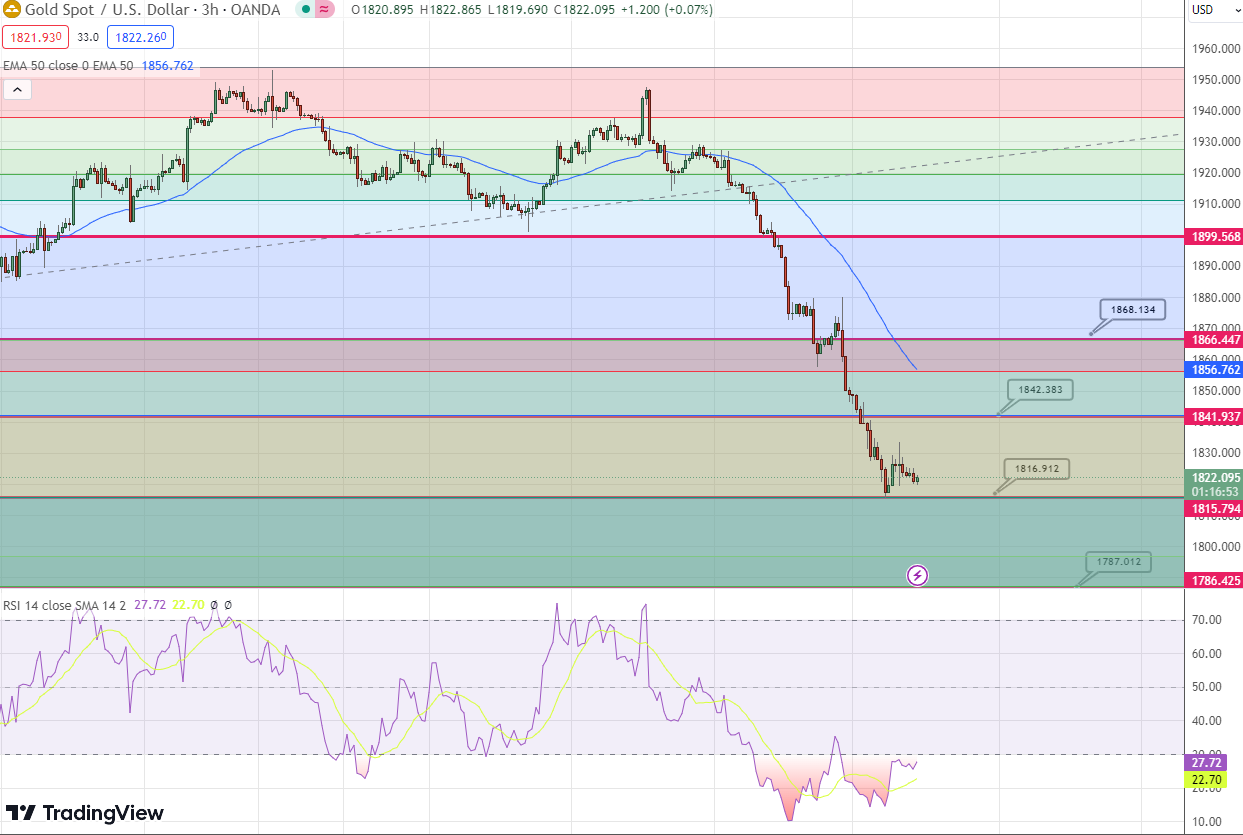

Gold Technical Analysis

Gold’s RSI on its daily spectrum indicates pronounced oversold signals, advocating for a transitory phase of stabilization or a slight upward rebound ahead of any further downturn. However, the conspicuous absence of robust buying intent underscores a continued bearish bent for Gold.

A possible descent below Tuesday’s multi-month nadir of $1,815 edges closer to testing the significant $1,800 threshold. Should the downtrend persist, we could witness the metal gravitating towards the $1,770-1,760 bracket.

Conversely, any upswing might encounter pronounced resistance, potentially stifling its ascent near the $1,830-1,832 zone. A durable rally beyond this realm could instigate a wave of short-covering, elevating Gold towards the $1,850 mark, with potential aspirations to breach the formidable $1,858-1,860 barrier.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account